ccvediogames.online Prices

Prices

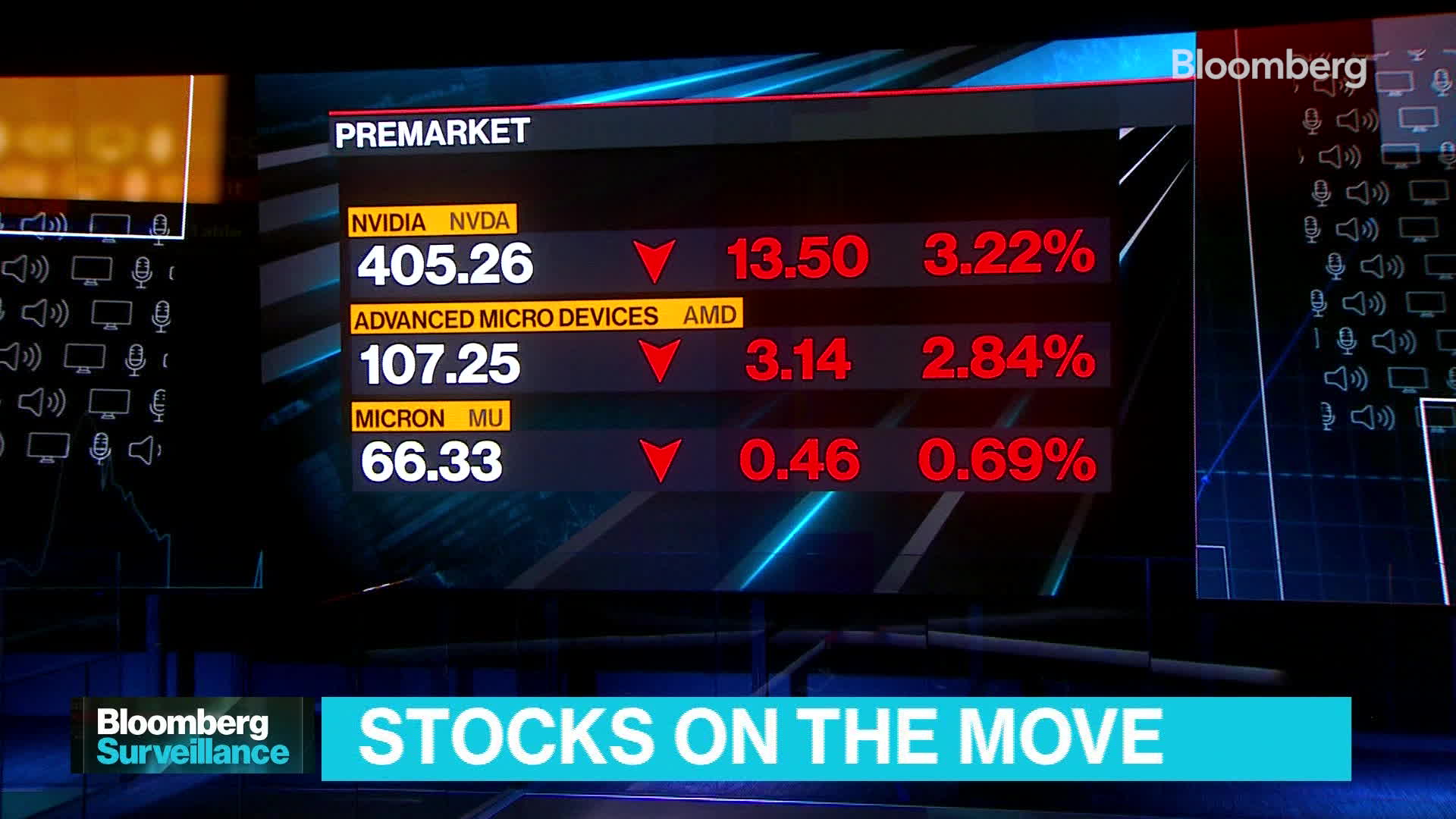

Early Morning Stock Movers

Pre-market trading for U.S. stocks highlighting the best pre-market movers, gaps, volume leaders, advances and declines. The Pre Open Market is the period of trading activity that occurs before the regular market session. Investors and traders analyse the pre-market trading. When does premarket open? Premarket occurs 7 am EST to am EST Monday - Friday. After-hours trading occurs from 4 pm EST to 8 pm EST during the workweek. FedEx (FDX) after that day's close appears to be the standout and could provide early insight into overall consumer and business demand. Shares soared double. Thousands of stock traders are drawn to the exchanges immediately following the opening bell. The stock market is crowded during regular hours of trading which. Prices of stocks traded in the pre-market may diverge significantly from the prices of those same stocks during regular hours. Apart from the impact on stock. Leaders ; RH · RH. $ ; ORCL · Oracle Corp. $ ; UBER · Uber Technologies Inc. $ ; WOLF · Wolfspeed Inc. $ ; W · Wayfair Inc. Cl A. $ Stock Movers ; HCTI · Healthcare Triangle ; MCAGR · Mountain Crest Acquisition Corp. V - Right ; AEHL · Antelope Ent Hldgs ; AOTG · AOT Growth and Innovation ETF. Pre-market stock trading coverage from CNN. Get the latest updates on pre-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. Pre-market trading for U.S. stocks highlighting the best pre-market movers, gaps, volume leaders, advances and declines. The Pre Open Market is the period of trading activity that occurs before the regular market session. Investors and traders analyse the pre-market trading. When does premarket open? Premarket occurs 7 am EST to am EST Monday - Friday. After-hours trading occurs from 4 pm EST to 8 pm EST during the workweek. FedEx (FDX) after that day's close appears to be the standout and could provide early insight into overall consumer and business demand. Shares soared double. Thousands of stock traders are drawn to the exchanges immediately following the opening bell. The stock market is crowded during regular hours of trading which. Prices of stocks traded in the pre-market may diverge significantly from the prices of those same stocks during regular hours. Apart from the impact on stock. Leaders ; RH · RH. $ ; ORCL · Oracle Corp. $ ; UBER · Uber Technologies Inc. $ ; WOLF · Wolfspeed Inc. $ ; W · Wayfair Inc. Cl A. $ Stock Movers ; HCTI · Healthcare Triangle ; MCAGR · Mountain Crest Acquisition Corp. V - Right ; AEHL · Antelope Ent Hldgs ; AOTG · AOT Growth and Innovation ETF. Pre-market stock trading coverage from CNN. Get the latest updates on pre-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures.

Premarket Gainers ; 2, NOVV, Nova Vision Acquisition Corporation, %, ; 3, VMAR, Vision Marine Technologies Inc. %, Discover top US stocks surging right now with Webull's real-time gainers list. Track hot companies & make informed trades Top Gainers. Pre-market. After-hours. Pre-market movers are the stocks that are moving after the market closes for the day and before it opens the next morning. Biggest movers among U.S.-listed issues outside of regular trading hours with a minimum share price of $2 and minimum pre-market or after-hours volume of 5, Top gaining US stocks in pre-market ; SONN · D · +%, USD ; HTOO · D · +%, USD ; WINT · D · +%, USD ; NNCPL · D · +%, USD. Zacks #1 Rank Top Movers for Sep 13, Zacks #1 Rank Top Movers Zacks #1 Rank Top Movers for 09/15/24 ; Land's End LE Quick Quote LE ; Veracyte, VCYT Quick. Market Movers · Bicara Therapeutics Inc. $ BCAX. +$ (%) · Redfin Corp. $ RDFN. +$ (%) · RH. $ RH. +$ (%) · BioNTech. Hottest stocks trading today on the U.S. Markets. Gainers and decliners of the largest equities on the S&P , Nasdaq Composite and Dow Jones Industrial. STOCK RECOMMENDATIONS BY BROKER RESEARCH HOUSES. market views: daily morning report by top brokerage houses. All. Markets. Commodities. Currencies. FII & DII. Where the stock market will trade today based on Dow Jones Industrial Average, S&P and Nasdaq futures and implied open premarket values. Premarket Gainers ; 8, SYRS, Syros Pharmaceuticals, Inc. ; 9, CNTA, Centessa Pharmaceuticals plc ; 10, NCPL, Netcapital Inc. ; 11, WINT, Windtree Therapeutics, Inc. The Pre-Market Indicator is calculated based on last sale of Nasdaq securities during pre-market trading, to am ET. Stocks ; ASTS AST SpaceMobile, Inc. + (+%). + ; WBD Warner Bros. Discovery, Inc. + (+%). + ; DNLI Denali Therapeutics Inc. Top gaining US stocks in post-market ; BBLG · D · +%, USD ; EAST · D · +%, USD ; BURU · D · +%, USD ; CJET · D · +%, USD. DJT Stock Gains With Trump, Harris Neck and Neck Ahead of Debate. Expect More Volatility. Elsa Ohlen. September 10, pm ET. Markets are gearing. A: Premarket trading sessions start weekdays around am EST and last until the market open, which is am EST. Q: Can you trade options premarket? A. pre-market movers ; Dow Jones Industrial Average Today Moving on Fresh Jobs Report. August 7, ; Dow Jones Industrial Average Today Falling on Weak GDP Report. Pre-market stock movers are a great way to start the week as we check out all of the biggest trades happening on Monday morning!More From InvestorPlace The. Pre-market movers are the stocks that are moving after the market closes for the day and before it opens the next morning. Pre Market Most Active Stocks ; Agape ATP Corp, ATPC, , + ; Tenon Medical Inc, TNON, , +

Best Platforms To Buy Altcoins

For beginners, Bybit's spot trading markets enable straightforward buying and selling of altcoins without leverage. For more seasoned traders. Joystream is a blockchain video platform and DAO that aims to revolutionize content creation and sharing. With a market cap of around $37 million, this lowcap. Buying many altcoins requires just a few steps beyond purchasing bitcoin. In this article, we recommend purchasing BTC and trading BTC for the desired altcoin. Bybit lets you trade options on crypto as well as buying tokens. You can trade BTC and ETH, with trades being settled in USDC, a popular stablecoin. How To Trade Altcoins ? Trading Platforms & Strategies – TradeSanta Despite BTC's dominance in the crypto market (around 40% of total market. Cardano has distinguished itself in the cryptocurrency world as a research-driven blockchain platform. It stands out for its rigorous approach to development. These exchanges include Coinbase, eToro, Bitpanda, Binance, KuCoin, etc. You can decide on the best altcoin exchanges to buy and trade based on criteria. This platform's longstanding reputation makes it an excellent choice for acquiring altcoins. It provides numerous convenient pathways to buy altcoins with USD. Coinmama - A Top-Rated Choice. Best altcoin exchange: Coinmama. Coinmama is a pretty well-known crypto exchange that was established all the way back in For beginners, Bybit's spot trading markets enable straightforward buying and selling of altcoins without leverage. For more seasoned traders. Joystream is a blockchain video platform and DAO that aims to revolutionize content creation and sharing. With a market cap of around $37 million, this lowcap. Buying many altcoins requires just a few steps beyond purchasing bitcoin. In this article, we recommend purchasing BTC and trading BTC for the desired altcoin. Bybit lets you trade options on crypto as well as buying tokens. You can trade BTC and ETH, with trades being settled in USDC, a popular stablecoin. How To Trade Altcoins ? Trading Platforms & Strategies – TradeSanta Despite BTC's dominance in the crypto market (around 40% of total market. Cardano has distinguished itself in the cryptocurrency world as a research-driven blockchain platform. It stands out for its rigorous approach to development. These exchanges include Coinbase, eToro, Bitpanda, Binance, KuCoin, etc. You can decide on the best altcoin exchanges to buy and trade based on criteria. This platform's longstanding reputation makes it an excellent choice for acquiring altcoins. It provides numerous convenient pathways to buy altcoins with USD. Coinmama - A Top-Rated Choice. Best altcoin exchange: Coinmama. Coinmama is a pretty well-known crypto exchange that was established all the way back in

Our top recommendation for a safe platform is eToro. 1. eToro. etoro-platform. eToro, allows customers to purchase Bitcoin and more than 75 other. Listing the best altcoins to buy in · Pepe Unchained (PEPU): Ethereum L2 meme coin has raised over $4 million on presale. · Crypto All-Stars (STARS): Stake. 8 best altcoins in · 1. Ethereum (ETH). Market cap: $ billion. 1-year return: 77% · 3. Solana (SOL). Market cap: $ billion. 1-year return: % · 5. Some well-known cryptocurrency exchanges for altcoin trading include Coinbase, Binance, KuCoin, Bybit, and ccvediogames.online Before investing, ensure that the. Binance is best known for its crypto-to-crypto trading, and since the platform doesn't use fiat money as a trading option, it does an excellent job at that. Best Exchanges For Altcoins · ccvediogames.onlinee. thumb · ccvediogames.onlineex. thumb · ccvediogames.online thumb · ccvediogames.online thumb · ccvediogames.online thumb · ccvediogames.onlinese Pro. thumb · ccvediogames.onlinex. thumb · 8. Founded in , eToro delivers an accessible trading experience to over 35 million customers from more than countries. Clients can conveniently buy, sell. Cardano has distinguished itself in the cryptocurrency world as a research-driven blockchain platform. It stands out for its rigorous approach to development. You can purchase BNB and other top altcoins directly within the Binance app. Discover how to buy altcoins on Binance. Based on these considerations, we believe the best altcoin exchange is eToro, which is easy to use and has competitive fees, a range of free deposit options. buy altcoins. Some of the top exchanges inclu platforms to find the ones that best match your preferences. If. BYDFi ranks number one in our list of the best altcoin trading platforms and it's getting a lot of attention in the crypto community. Whether you're just. Our platform offers the lowest fees and highest security to buy and sell ALT Celebrating the best of the last 6 months at AltLayer We launched. According to community discussions, some of the top platforms to buy altcoins include Binance, Coinbase, Kraken, and Bitfinex. These platforms. To buy altcoins with USD you can use a well-established crypto exchange like MEXC, which offers more than 2, tradable altcoins. Open an account and complete. Over million users buy, sell, and trade Bitcoin, Ethereum, NFTs and more on ccvediogames.online Join the World's leading crypto trading platform. Best Crypto to Invest In · Bitcoin: Price—$64,, market cap—$ trillion, hour trading volume—$ billion, as of Aug. · Ethereum: Price—$3, Solana is one of the best cryptocurrencies to buy right now. While we've heard the term 'Ethereum Killer' since the bull cycle, Solana is the most. Over million users buy, sell, and trade Bitcoin, Ethereum, NFTs and more on ccvediogames.online Join the World's leading crypto trading platform.

Pawn Shops That Take Clothes

Prep Your Clothes · Stop By The Store · Pick Your Payout · What we buy · We pay instant cash · For items that are: · Clothing · Toys & Games · Baby Gear. items we buy & sell. Each Kid to Kid store is locally owned and locally stocked with carefully selected gently used items and an affordable and unique selection. Best Pawn Shop NYC. Jewelry Electronics Gift Cards Clothing #webuy #wesell #wepawn DM or Call/Text ccvediogames.online Location's. From Business: The Salvation Army donation centers accept clothes donations, furniture donations, car donations, and other gently used goods. All items sold. I don't see why not! Pawn shops are always looking for new inventory, and selling used clothes is a great way to make some extra cash. store credit for anything we're able to buy. Shop! Store credit (trade) gets you the most money for selling clothing! We get new inventory all day, every. They take electronics, tools, jewelry, guns, collectables. Not usually clothes unless it's something collectable. (ie: a jacket worn by a. Pickups for large donations only or buy donation bag and shipping label online. Women and men's clothing, children's clothing, shoes, sneakers, boots, hats. Pawn shops usually will not accept items that are clearly replicas (such as fake designer purses). They also do not typically accept clothing or books. Prep Your Clothes · Stop By The Store · Pick Your Payout · What we buy · We pay instant cash · For items that are: · Clothing · Toys & Games · Baby Gear. items we buy & sell. Each Kid to Kid store is locally owned and locally stocked with carefully selected gently used items and an affordable and unique selection. Best Pawn Shop NYC. Jewelry Electronics Gift Cards Clothing #webuy #wesell #wepawn DM or Call/Text ccvediogames.online Location's. From Business: The Salvation Army donation centers accept clothes donations, furniture donations, car donations, and other gently used goods. All items sold. I don't see why not! Pawn shops are always looking for new inventory, and selling used clothes is a great way to make some extra cash. store credit for anything we're able to buy. Shop! Store credit (trade) gets you the most money for selling clothing! We get new inventory all day, every. They take electronics, tools, jewelry, guns, collectables. Not usually clothes unless it's something collectable. (ie: a jacket worn by a. Pickups for large donations only or buy donation bag and shipping label online. Women and men's clothing, children's clothing, shoes, sneakers, boots, hats. Pawn shops usually will not accept items that are clearly replicas (such as fake designer purses). They also do not typically accept clothing or books.

I never thought I was going to walk into a pawnshop but I kept hearing my friend say stop by this pawnshop on Walnut St., Capitol City pawn shop?!! From Business: Another Child is a quality resale shop, specializing in children’s and maternity clothing. We carry a variety of needs for expecting mothers to. Whether a customer is short of cash or browsing for a bargain, the folks at A & D will take good care of you. Rick X. Brookstone. Women's specialty clothing. Don't wait for buyers for your items. Just pawn or sell them at EZPAWN for cash. We deal in electronics, collectibles, jewelry, toolkits. Visit us today! At EZPAWN, we have a wide selection of designer handbags from top brands. Brands we carry include Saint Laurent TM, Michael KorsTM, Chanel TM, Louis Vuitton TM. They take electronics, tools, jewelry, guns, collectables. Not usually clothes unless it's something collectable. (ie: a jacket worn by a. Shop & Sell Items at Pawn America Pawn Shops Near You. Make money FAST & save thousands on fine jewelry, watches, video games, computers, electronics +. take a look around the women's section. So glad I did! Some of their Womens Clothing Consignment Shops · Mens Consignment · Consignment Clothing. Very nice place with cool items and clothing, I know this is where I Will be selling my high end items again! Rudolf Suyunov. Get Cash for your Goods Today. Home Key Largo Clothing and Accessories Jewelry and Watches. Coral Financial Pawn Shops & Discount Stores. Overseas Hwy Key Largo, FL , Key. Upgrade your wardrobe at Cashaway Pawn Shop! Buy and sell clothing, shoes, and fashion items. Find unique styles and great deals with us. Need instant cash or a quick loan? Have bad credit? Facing a financial emergency? Looking for cash for your designer clothing, bags, shoes? While you look around the store to see our freshest inventory, we'll check out your items. What items do you buy? Children's clothing, shoes, toys and baby. Luxury Pawning is a practice where you take your valuable items to a pawnshop to receive a loan based on the item's value. Call ahead to see if your local store can accept them. What Not to Donate Thrift shopping is both a money-saving and ethical way to shop for clothes. clothing collection. Teen Challens Resignments, located in Jersey City, USA, has a variety of handicrafts. You can buy clothes from the Lucky Thrift Store. PAWN SHOP A charitable curation of vintage and secondhand pieces by Helena Christensen and Camilla Stæccvediogames.onlineds from Pawn Shop are donated to charities. Boutiques, Clothing, Shoes & Consignment. Bow and Arrow Boutique Closed Today. · Business Details · Dave's Pawn Shop Open Today: Closed. () items we buy & sell. Each Kid to Kid store is locally owned and locally stocked with carefully selected gently used items and an affordable and unique selection. Pomona Pawn Shop located in the city of Pomona California, established in We offer an inventory that contains a variety of tools, electronics.

Can You Fund A Roth Ira And A 401k

_to_a_Roth_IRA_Account.png?width=2626&name=Steps_in_Rolling_Over_a_Roth_401(k)_to_a_Roth_IRA_Account.png)

Yes, for , if you are age 50 or older, you can make a contribution of up to $27, to your (k), (b) or governmental (b) plan ($20, regular and. Yes. You can contribute to an IRA even if you or your jointly-filing spouse are covered by an employer-sponsored retirement plan, such as a (k). You can have a (k) and an IRA - they have separate contribution limits. You can make both Traditional and Roth contributions to a (k), but. You can also roll over or convert funds from an employer plan [such as a (k)] to a Roth IRA. You can roll over amounts held in a Roth employer plan account. Can you contribute to a (k) and Roth IRA? The short answer is yes, but make sure that you understand these rules, regulations, and limitations. Do not transfer your (k) or Rollover IRA into an RRSP. Minimize exposure to anything the IRS treats as a PFIC (Passive Foreign Investment Company). You may. No. Although you can contribute to a traditional or Roth IRA for your spouse based on your earned income, you cannot contribute to a Roth (k). If you earn too much to contribute to a Roth IRA, you can still get one by converting traditional IRA or (k) money. Learn more about the potential. Yes, under certain circumstances you can have both a k and a Roth IRA. Understand the rules for contributing to a (k) and a Roth IRA, including limits. Yes, for , if you are age 50 or older, you can make a contribution of up to $27, to your (k), (b) or governmental (b) plan ($20, regular and. Yes. You can contribute to an IRA even if you or your jointly-filing spouse are covered by an employer-sponsored retirement plan, such as a (k). You can have a (k) and an IRA - they have separate contribution limits. You can make both Traditional and Roth contributions to a (k), but. You can also roll over or convert funds from an employer plan [such as a (k)] to a Roth IRA. You can roll over amounts held in a Roth employer plan account. Can you contribute to a (k) and Roth IRA? The short answer is yes, but make sure that you understand these rules, regulations, and limitations. Do not transfer your (k) or Rollover IRA into an RRSP. Minimize exposure to anything the IRS treats as a PFIC (Passive Foreign Investment Company). You may. No. Although you can contribute to a traditional or Roth IRA for your spouse based on your earned income, you cannot contribute to a Roth (k). If you earn too much to contribute to a Roth IRA, you can still get one by converting traditional IRA or (k) money. Learn more about the potential. Yes, under certain circumstances you can have both a k and a Roth IRA. Understand the rules for contributing to a (k) and a Roth IRA, including limits.

You can set it up so that any after-tax contributions (if your plan allows them) are automatically converted to a Roth (k) at regular intervals. Taxes on a. If you have the money to do so, contributing to both a (k) and an IRA could help you fast track your retirement goals while enjoying some tax savings. But. This is when you roll over or "convert" funds from non-Roth accounts, such as traditional IRAs, (b)s, and (k)s, into a new Roth IRA. You pay taxes when. Different portfolios will grow at different rates. In some cases, you may want to move funds from a smaller (k) to a rollover IRA. This gives you greater. Even if you contribute the maximum amount to a (k), you can still contribute to a Roth IRA in the same year, unless your income exceeds the eligibility limit. The simple answer is yes, you can. However, there are some caveats when it comes to deducting your IRA contributions if you participate in both types of plans. For example, if you contribute $2, to your traditional IRA, you can only contribute $5, to your Roth IRA, for a total of $7, Understanding income. Finally, a Roth (k) is only available through an employer plan. As long as you meet the above MAGI income requirements, you can open a Roth IRA on your own. You can also roll over or convert funds from an employer plan [such as a (k)] to a Roth IRA. You can roll over amounts held in a Roth employer plan account. You can fund a Roth IRA on behalf of someone else, including a minor, as long as the owner is eligible to contribute. While Roth IRA contributions aren't. You may choose to split your contributions between Roth and traditional (k)s, but your combined contributions can't exceed $22, ($30, if you're age IRA stands for individual retirement account. · If you're eligible, you can contribute to both a Roth and traditional IRA in the same year—though you can only. The good news is you don't have to choose between a Roth (k) and a Roth IRA — you can have both. If you receive a Roth (k) through your employer. Key Points · You can only participate in a (k) through your job, whereas anyone with earned income can fund a Roth IRA. · Roth IRAs are always funded post-tax. If you have a Roth (k) at work, that plan will likely come out on top—especially if your employer offers a match. But both are powerful savings tools, and. The easy answer to your second question is again, yes, you can potentially contribute to a Roth IRA even if you contribute the yearly maximum to. Yes, you can, but only if you have taxable compensation. Roth IRAs were designed to help people save for retirement with the advantage of tax-free growth. If possible, experts recommend that you first take full advantage of any (k) matching funds, then max your Roth IRA contributions, and then go back to. So although you can contribute to both accounts, your combined contributions cannot exceed the IRA contribution limit—or you may face tax penalties. You also. Can I roll my (k) into an IRA? Yes. If you have assets in a (k) with an employer that you no longer work for, you can roll over these assets. You can.

Stock Loss Harvesting

Tax-loss harvesting is the method of selling investments that have fallen in value to offset investment gains or other income to reduce the amount of money. You can offset capital losses against your capital gains to reduce your total taxable income (gain). Once you've identified the right assets for tax loss. Tax-loss harvesting lowers current federal taxes by deliberately incurring capital losses to offset taxes owed on capital gains or personal income. Tax-loss harvesting is the method of selling investments that have fallen in value to offset investment gains or other income to reduce the amount of money. Tax-loss harvesting allows you to sell investments that are down, replace them with reasonably similar investments, and then offset realized investment gains. Neither the tax-loss harvesting strategy, nor any discussion herein, is intended as tax advice and Charles Schwab & Co., Inc. does not represent that any. Tax-loss harvesting can help lower your taxes. See how to use this strategy while avoiding a wash sale. Tax-loss harvesting is an investment strategy that allows you to reduce your taxable investment income by offsetting your capital gains with losses. When. Tax loss harvesting is when you sell securities for less than their cost basis, or the price you originally paid for them. This captures losses to offset gains. Tax-loss harvesting is the method of selling investments that have fallen in value to offset investment gains or other income to reduce the amount of money. You can offset capital losses against your capital gains to reduce your total taxable income (gain). Once you've identified the right assets for tax loss. Tax-loss harvesting lowers current federal taxes by deliberately incurring capital losses to offset taxes owed on capital gains or personal income. Tax-loss harvesting is the method of selling investments that have fallen in value to offset investment gains or other income to reduce the amount of money. Tax-loss harvesting allows you to sell investments that are down, replace them with reasonably similar investments, and then offset realized investment gains. Neither the tax-loss harvesting strategy, nor any discussion herein, is intended as tax advice and Charles Schwab & Co., Inc. does not represent that any. Tax-loss harvesting can help lower your taxes. See how to use this strategy while avoiding a wash sale. Tax-loss harvesting is an investment strategy that allows you to reduce your taxable investment income by offsetting your capital gains with losses. When. Tax loss harvesting is when you sell securities for less than their cost basis, or the price you originally paid for them. This captures losses to offset gains.

Tax-Loss Harvesting helps turn a dip in the market into a tax deduction. When you claim a loss on an investment, you can lower your tax bill at the end of. You can offset capital losses against your capital gains to reduce your total taxable income (gain). Once you've identified the right assets for tax loss. Technology-driven tax loss harvesting · The upside to capital losses. Realized losses on investments can offset gains and reduce ordinary taxable income by as. Tax-loss harvesting—offsetting capital gains with capital losses—can lower your tax bill and better position your portfolio going forward. Tax-loss harvesting is the timely selling of securities at a loss to offset the amount of capital gains tax owed from selling profitable assets. Tax-loss harvesting is the timely selling of securities at a loss to offset the amount of capital gains tax owed from selling profitable assets. Tax Loss Harvesting is where you to take losses on securities positions trading below their cost basis. These losses can be used to offset gains realized on. Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains and/or regular income.¹. The U.S. federal government allows investors. Tax-loss harvesting involves selling underperforming investments and using the losses to offset gains from other investments or ordinary income. · Even if you. Tax-loss harvesting is a practice of selling a security that has incurred a loss to help investors reduce or offset taxes on any capital gains income subject. Tax loss harvesting involves taking the losses of Investment B to offset the capital gains from Investment A—thereby reducing your tax liability. Your $35, When you sell an investment within a non-registered account, such as a stock or a bond, for less than its adjusted cost base (ACB), it triggers a capital loss. Tax-loss harvesting is a strategy that can enhance after-tax returns by offsetting realized capital gains with realized capital losses. When executed properly. Tax-loss harvesting is a strategy for managing a portfolio. An investor sells an investment at a loss to offset gains and taxable income, resulting in tax. This is called tax loss harvesting. There are three benefits. First, tax losses are effectively an interest-free loan which defers capital gains taxes you would. Tax-loss harvesting is a strategy of selling investments at a loss in order to lower taxes. Losses are typically used to offset gains, such as those from. Capital gains are generally the profits you realize when you sell an investment for more than you paid for it, and capital losses are generally the losses you. One of the most common strategies for reducing capital gains -- and therefore, capital gains taxes -- is known as tax loss harvesting. Read on to learn what it. Have a lot of appreciated company stock? Diversifying to reduce risk means realizing some capital gains. Systematic loss harvesting in a direct indexing. Technology-driven tax loss harvesting · The upside to capital losses. Realized losses on investments can offset gains and reduce ordinary taxable income by as.

Bitcoin.Tax

If you held a particular cryptocurrency for more than one year, you're eligible for tax-preferred, long-term capital gains, and the asset is taxed at 0%, 15%. Discover how EY professionals can help you meet compliance obligations and develop a tax approach for digital currencies that will serve you well into the. CoinTracker is more than just a portfolio tracker; it's a comprehensive solution for managing crypto investments and tax obligations. Its ease of use, extensive. Discover how EY professionals can help you meet compliance obligations and develop a tax approach for digital currencies that will serve you well into the. Automatically calculate your crypto tax report · Compliant with the latest IRS guidance · Preview your capital gains for free · Automatically generate IRS FORM. The IRS treats cryptocurrencies as property, meaning sales are subject to capital gains tax rules. Be aware, however, that buying something with cryptocurrency. How much do I owe in crypto taxes? · Long-term gains are taxed at a reduced capital gains rate. These rates (0%, 15%, or 20% at the federal level) vary based on. We offer the most cost-effective solution for calculating cryptocurrency gains and losses. Other products will charge you hundreds just to handle a small. Crypto taxes work similarly to taxes on other assets or property. They create taxable events for the owners when they are used and gains are realized. If you held a particular cryptocurrency for more than one year, you're eligible for tax-preferred, long-term capital gains, and the asset is taxed at 0%, 15%. Discover how EY professionals can help you meet compliance obligations and develop a tax approach for digital currencies that will serve you well into the. CoinTracker is more than just a portfolio tracker; it's a comprehensive solution for managing crypto investments and tax obligations. Its ease of use, extensive. Discover how EY professionals can help you meet compliance obligations and develop a tax approach for digital currencies that will serve you well into the. Automatically calculate your crypto tax report · Compliant with the latest IRS guidance · Preview your capital gains for free · Automatically generate IRS FORM. The IRS treats cryptocurrencies as property, meaning sales are subject to capital gains tax rules. Be aware, however, that buying something with cryptocurrency. How much do I owe in crypto taxes? · Long-term gains are taxed at a reduced capital gains rate. These rates (0%, 15%, or 20% at the federal level) vary based on. We offer the most cost-effective solution for calculating cryptocurrency gains and losses. Other products will charge you hundreds just to handle a small. Crypto taxes work similarly to taxes on other assets or property. They create taxable events for the owners when they are used and gains are realized.

Cryptocurrency accounting subledger that aggregates your data and integrates it with the rest of your financial stack in a secure and auditable manner. Crypto can be taxed as capital gains or ordinary income. Here are some of the most common triggers. Note that these lists are not exhaustive. This Revenue Ruling discusses the tax implications of two previously unsettled areas of tax law: “hard forks” and “air drops.” The IRS also updated its FAQs on. Any transactions that use Bitcoin will be taxed in the same way as property. This means that you need to report any Bitcoin transactions you do to the IRS so. Accurate, easy-to-use tax software for cryptocurrency, DeFi and NFTs. Supports all CEXs, DEXs, Ethereum, Solana, Arbitrum and many more chains. ZenLedger is the best crypto tax software. Our crypto tax tool supports over + exchanges, tracks your gains, and generates tax forms for free. Learn about the regulations and tax implications of trading one cryptocurrency for another and more in our comprehensive guide. You might need any of these crypto tax forms, including Form , Schedule D, Form , Schedule C, or Schedule SE to report your crypto activity. Generate tax Form on a crypto service and then prepare and e-file your taxes on FreeTaxUSA. Premium federal taxes are always free. If you sold bitcoin on Cash App, you may owe taxes relating to such sale(s). Cash App will provide you with your IRS Form B based on the IRS Form W Meanwhile, long-term Capital Gains Tax for crypto is lower for most taxpayers. You'll pay a 0%, 15%, or 20% tax rate depending on your taxable income. If you. Bitcoin earned as compensation for goods and services, interest, staking, or mining will be taxed at your standard income tax rate. ccvediogames.online Tax offers the best free crypto tax calculator for Bitcoin tax reporting and other crypto tax solutions. Straightforward UI which you get your. You're required to pay taxes on crypto. The IRS classifies cryptocurrency as property, and cryptocurrency transactions are taxable by law. In this post, we'll cover what cryptocurrency is, the basics and what you need to know about cryptocurrency taxes, including a breakout of your tax. Crypto Currency Now Accepted For All State Tax PaymentsStarting September 1, , the Colorado Department of Revenue (DOR) will now accept Cryptocurrency. Cryptocurrency investors need to be aware that failing to report income and pay tax on cryptocurrency investment returns can have severe tax implications. Learn about the regulations and tax implications of trading one cryptocurrency for another and more in our comprehensive guide. So, for example, say your salary was paid in part cash and part Bitcoin, and each month you received $ worth of Bitcoins, you are taxed like you had just. This handy guide will give you a complete state-by-state breakdown of cryptocurrency sales and use tax laws and regulations.

Stocks Of Companies With Exposure To Cryptocurrency

:max_bytes(150000):strip_icc()/TSLA_2023-12-08_12-43-41-d61daa4beab042ce8177895339ce6abd.png)

Individual Stocks and Funds · Altcoin Altcoin is a term used to describe any cryptocurrency other than bitcoin. · Blockchain · Cold Storage · Cryptocurrency · Crypto. We are one of the largest crypto investment companies The Hashdex Bitcoin ETF provides exposure to the world's first decentralized blockchain-based digital. Find the best bitcoin stocks with the highest Smart score. Compare bitcoin-related companies and stocks by growth, price, analysts ratings, and more. Even though the new Bitcoin ETFs provide investment exposure to the cryptocurrency, this does not change the when stocks rise, Bitcoin also rises and when. FDIG currently has around 45 holdings. The top 10 stocks account for nearly 60% of its net assets. The three biggest stocks by weighting are Coinbase Global. It invests in companies listed in the Schwab Crypto Thematic Index and is designed to deliver global exposure to companies that may benefit from the. FDIG currently has around 45 holdings. The top 10 stocks account for nearly 60% of its net assets. The three biggest stocks by weighting are Coinbase Global. Simple access to digital assets. Our crypto ETPs allow you to invest in cryptocurrencies via your bank or broker - just as you would with traditional stocks and. Precise bitcoin exposure with IBIT. iShares Bitcoin Trust In general, millennial investors are more likely to hold crypto than stocks or mutual funds. Individual Stocks and Funds · Altcoin Altcoin is a term used to describe any cryptocurrency other than bitcoin. · Blockchain · Cold Storage · Cryptocurrency · Crypto. We are one of the largest crypto investment companies The Hashdex Bitcoin ETF provides exposure to the world's first decentralized blockchain-based digital. Find the best bitcoin stocks with the highest Smart score. Compare bitcoin-related companies and stocks by growth, price, analysts ratings, and more. Even though the new Bitcoin ETFs provide investment exposure to the cryptocurrency, this does not change the when stocks rise, Bitcoin also rises and when. FDIG currently has around 45 holdings. The top 10 stocks account for nearly 60% of its net assets. The three biggest stocks by weighting are Coinbase Global. It invests in companies listed in the Schwab Crypto Thematic Index and is designed to deliver global exposure to companies that may benefit from the. FDIG currently has around 45 holdings. The top 10 stocks account for nearly 60% of its net assets. The three biggest stocks by weighting are Coinbase Global. Simple access to digital assets. Our crypto ETPs allow you to invest in cryptocurrencies via your bank or broker - just as you would with traditional stocks and. Precise bitcoin exposure with IBIT. iShares Bitcoin Trust In general, millennial investors are more likely to hold crypto than stocks or mutual funds.

Stocks represent equity in a company, a claim on part of the company's assets and earnings. They're deeply entrenched in our financial systems and connected to. Broad exposure to a large basket of opportunities “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license. Roughly 2, US businesses accept bitcoin, according to one estimate from late , and that doesn't include bitcoin ATMs 1. An increasing number of companies. exposure to companies that use blockchain technology. Footnotes. 1 shares in an investment company registered under the Act. Related insights. Cryptocurrency Stocks · Coinbase · MicroStrategy · Visa · PayPal · Riot Platforms · Beyond. The WisdomTree Bitcoin Fund's shares Though neither invests directly in bitcoin, GCC and WTMF are among the first U.S. ETFs to offer bitcoin futures exposure. Ethereum exposure without the hassle of buying ETH directly. Simplified All entities mentioned are Franklin Templeton affiliates companies. Crypto futures markets are being established, and many companies are gaining direct exposure to the cryptocurrency sector. Financial giants such as Block (SQ. Precise bitcoin exposure with IBIT. iShares Bitcoin Trust In general, millennial investors are more likely to hold crypto than stocks or mutual funds. Fund Highlights ; Simplicity: Cost-efficient exposure to bitcoin through an ETF ; Institutional Custody: Shares are physically backed by bitcoin and held in cold. Invest in ETFs like Amplify Data Sharing or Reality Shares Nasdaq for blockchain exposure. Buy stocks of companies using blockchain, such as Walmart or PayPal. You can also invest in the stocks of companies within the blockchain and cryptocurrency industries, which gives you exposure to cryptocurrencies without. Broad exposure to a large basket of opportunities “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license. Provides exposure to the growing crypto ecosystem through investing in companies The Schwab Crypto Thematic ETF invests in a portfolio of securities. Holdings. as of 9/12/ Weight, Ticker, Description, Exposure Value (Notional + GL), Market Value, Shares/Contracts, SEDOL Number. %, --, CME BITCOIN. 2. Valkyrie Bitcoin Miners ETF (WGMI) · Marathon Digital Holdings Inc., % · Riot Platforms, % · Cipher Mining Inc., % · Hive Blockchain Technologies. Crypto ETFs stand out because they're traded on traditional stock exchanges, enabling investors to gain cryptocurrency exposure without directly owning any. A bitcoin futures exchange-traded fund (ETF) issues publicly traded securities that offer exposure to the price movements of bitcoin futures contracts. companies and the price of Bitcoin. By investing in stocks exposed to Bitcoin, the Fund will not necessarily or mechanically follow the price of Bitcoin. A secure way to get diversified exposure to bitcoin and leading cryptocurrencies. Transfer Agent. American Stock Transfer & Trust Company, LLC (AST). *.

Silver Price Last 10 Days

Live Silver Charts and Silver Spot Price from International Silver Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco. Silver Price For Last 10 Days in Delhi ; 27th Aug, ₹ (-₹3) ; 26th Aug, ₹ (+₹17) ; 25th Aug, ₹ (+₹5) ; 24th Aug, ₹ (-₹5). Stay updated with real-time charts of international precious metal prices. Track spot prices for Silver in USD, GBP, and EUR. Access live updates here >>. Silver Futures - Dec 24 (SIZ4) ; (%). Real-time Data ; Day's Range. 52 wk Range. Silver Mini Futures - Aug 24 (MSDc1) ; 84, (%). Real-time Data 30/08 ; Day's Range. 83, 84, 52 wk Range. 65, 96, SILVER RATE IN INDIA FOR LAST 10 DAYS ; Sep 01, , ₹ ; Aug 31, , ₹ ; Aug 30, , ₹ ; Aug 29, , ₹ Silver Price in USD per Troy Ounce for Last 10 Years. Ag. Current Price. $ 10 Year Change. %. 10 oz. 1 gram · 5 gram · Britannia's · Silver If you change the range to 'M' the chart will update and show silver price action over the last 30 days. Interactive chart of historical data for real (inflation-adjusted) silver prices per ounce back to The series is deflated using the headline Consumer. Live Silver Charts and Silver Spot Price from International Silver Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco. Silver Price For Last 10 Days in Delhi ; 27th Aug, ₹ (-₹3) ; 26th Aug, ₹ (+₹17) ; 25th Aug, ₹ (+₹5) ; 24th Aug, ₹ (-₹5). Stay updated with real-time charts of international precious metal prices. Track spot prices for Silver in USD, GBP, and EUR. Access live updates here >>. Silver Futures - Dec 24 (SIZ4) ; (%). Real-time Data ; Day's Range. 52 wk Range. Silver Mini Futures - Aug 24 (MSDc1) ; 84, (%). Real-time Data 30/08 ; Day's Range. 83, 84, 52 wk Range. 65, 96, SILVER RATE IN INDIA FOR LAST 10 DAYS ; Sep 01, , ₹ ; Aug 31, , ₹ ; Aug 30, , ₹ ; Aug 29, , ₹ Silver Price in USD per Troy Ounce for Last 10 Years. Ag. Current Price. $ 10 Year Change. %. 10 oz. 1 gram · 5 gram · Britannia's · Silver If you change the range to 'M' the chart will update and show silver price action over the last 30 days. Interactive chart of historical data for real (inflation-adjusted) silver prices per ounce back to The series is deflated using the headline Consumer.

Daily Silver Prices since ; 28 March · ; 27 March · ; 26 March · ; 25 March · ; 22 March ·

Silver Price is at a current level of , up from last month and up from one year ago. This is a change of % from last month and % from. 1 Troy Ounce ≈ 31,10 Gram, Silver Price Per 1 Gram, USD ; 1 Troy Ounce ≈ 0, Kilogram, Silver Price Per 1 Kilogram, USD. Silver Rate in India Today ; 1 gram. ₹ , - ₹ ; 8 grams. ₹ , - ₹ ; 10 grams. ₹ , - ₹ 22 ; grams. ₹ , - ₹ Silver Rate in Karnataka for Last 10 days ; 31 Aug , ₹ 92(1 ▽) ; 30 Aug , ₹ 93( ▽) ; 29 Aug , ₹ (0) ; 28 Aug , ₹ (0). Silver price site for fast loading live silver price charts in ounces, grams and kilos in every national currency in the world. The last silver peso was minted. [11]. On January 21, silver hit The mint asked dealers to provide their day and day forecasts for. Finance · My Portfolio · News · Latest News · Stock Market · Originals · Premium Jul 10, , , , , , , Jul 9, , Silver dipped below $29 per ounce, as the dollar and Treasury yields strengthened after U.S. inflation data met expectations. · Silver increased USD/t. Ask: $ USD Bid: $ USD ; Change: ($) USD (%) ; High: ; Low: ; Silver Spot Price · Live Metal Spot Prices (24 Hours) Last Updated: 9/2. Silver Price in Tamil nadu - Get 1 gram, 10 gram, 1kg silver price inTamil nadu today. Compare yesterday & last 10 days silver rate in Tamil nadu from. Silver Rate in India for Last 10 Days. Date, Silver /kg. Sep 2, , ₹ (-1,). Sep 1, , ₹ (0). Aug 31, , ₹ (-1,). Aug. Live Silver Spot Prices ; Silver Prices Per Ounce, $ ; Silver Prices Per Gram, $ ; Silver Prices Per Kilo, $ Update with silver rate today (3rd Sep ) & last 10 days silver price in India, based on rupees per gram/kg in major Indian cities. Over the past 10 Over the last half-a-century, gold and silver prices have generally moved in the same direction day-to-day, with silver prices tending to be. Au Bullion's Silver Price Page provides the latest real-time spot price of silver in the professional market. 30 Days, , %. 6 Months, Silver Mini Futures - Aug 24 (MSDc1) ; 84, (%). Real-time Data 30/08 ; Day's Range. 83, 84, 52 wk Range. 65, 96, Money Metals Exchange Live Silver Spot Prices ; Silver price per kilo, $ %. latest spot price by placing your order. Remember that the daily silver price is dynamic, changing throughout the trading day. Does the monetary. ounce. gram. Kilo. pennyweight. tola. tael. Day's Range. The silver price chart above shows the price of silver in dollars (USD) per Troy Ounce for Last 6 Months.

Vacation Rental Vs Investment Property

An investment property is a property you buy to generate income like to rent to tenants or flip and sell for a profit. However, a second home is a single-family. If you choose to rent your property as a short-term or vacation rental, you'll constantly have new guests arriving and departing. With this regular foot traffic. The biggest difference in qualifying for an investment property and vacation home is that the reserve assets needed on an investment property is greater, and. Long-term rentals are still an excellent source of passive income. However, because of rent price is constant throughout the lease period they may not generate. Many don't know that investment and vacation properties are financed differently. If you can qualify for your purchase without the property generating any. Considering Buying an Investment Property? Vacation Rental Versus Long Term Rental. Written by Merri Ann Simonson. Coldwell Banker San Juan Islands Inc. Now. If you receive rental income for the use of a dwelling unit, such as a house or an apartment, you may deduct certain expenses. These expenses, which may. It involves purchasing a residential or commercial property and renting it out to short-term tenants, such as tourists. Vacation rental investment has been. Lender here - a second home requires at least 10% down as noted above you have to qualify for the full payment without the rental offset. You can "legally". An investment property is a property you buy to generate income like to rent to tenants or flip and sell for a profit. However, a second home is a single-family. If you choose to rent your property as a short-term or vacation rental, you'll constantly have new guests arriving and departing. With this regular foot traffic. The biggest difference in qualifying for an investment property and vacation home is that the reserve assets needed on an investment property is greater, and. Long-term rentals are still an excellent source of passive income. However, because of rent price is constant throughout the lease period they may not generate. Many don't know that investment and vacation properties are financed differently. If you can qualify for your purchase without the property generating any. Considering Buying an Investment Property? Vacation Rental Versus Long Term Rental. Written by Merri Ann Simonson. Coldwell Banker San Juan Islands Inc. Now. If you receive rental income for the use of a dwelling unit, such as a house or an apartment, you may deduct certain expenses. These expenses, which may. It involves purchasing a residential or commercial property and renting it out to short-term tenants, such as tourists. Vacation rental investment has been. Lender here - a second home requires at least 10% down as noted above you have to qualify for the full payment without the rental offset. You can "legally".

Rental properties, whether leased short-term or long-term, are a great source of passive income. Of course, this is dependent on you buying at the right price. If you rent it out, it can only be short-term rentals. While it is generally easier to qualify for a second home loan than an investment property loan, if you. This is due to the excellent cap rate of vacation properties. Most investors examine the ratio between a property's net income and its market value as this. Going on vacation is something everyone looks forward to, and for many, staying in a rental property offers more freedom, flexibility, and privacy than. From a tax perspective, mortgage interest and property taxes are often deductible on a vacation home. Rental properties, on the other hand, allow for a wider. Competitors actively driving up prices can result in increased costs. Vacation rentals can saturate the market if you intend to rent the property when not there. However also fun to have a vacation home in your favorite spot. With remote work you could live there a lot and long term it would appreciate. An investment property can generate rental income, helping to offset the costs of ownership and potentially providing a profit. A vacation home, while not. Many investors shoot for above 10 percent when looking at vacation property rentals, but it can vary. In long-term rentals, for example, common cash on cash. In addition, as with the ownership of any equity, rental properties give the investor the possibility of earning profit from the appreciation, or increase in. Your rental income can possibly offset your mortgage and other expenses. Your home may appreciate in value over time, leaving you with a sizable nest egg or a. Investing in a vacation rental exposes you to lower risk than other types of real estate investments. First, vacation homes in top tourist destinations such as. If you're looking at real estate specifically from a money-making perspective, an investment property is the way to go. If you meet the stricter requirements. Rental Property Investor; Gatlinburg. ; Votes |: 1,; Posts · John Carbone #5 Short-Term & Vacation Rental Discussions Contributor. Property Manager. An increased acquisition cost for a vacation rental does not equal more revenue. Like bonds, the price of investment properties may fluctuate, but the income. The advantage of long-term rentals is that they require less work to manage, since you only have to clean and prepare the property once for each tenant. However. On top of that, vacation rental properties are a profitable business, with short-term investors yielding as much as 30% more than conventional landlords. Unlike traditional long-term rental properties, short-term rentals often have more variable income streams and may be subject to different regulations. As a. A vacation rental property that can generate enough rental income to pay for itself is a good place to start if you are interested in real estate investing. If. Here's how it works. Your property is considered a personal residence if you use it for more than the greater of 14 days OR 10% of the days it's rented. On the.

Good Cat Insurance

Embrace Pet Insurance · Pets Best Pet Insurance · ASPCA Pet Health Insurance; Pumpkin Pet Insurance; Fetch by the Dodo (previously Petplan) · Figo Pet Insurance. Best pet insurance of · $3+ discount per month with annual billing · day free trial · Up to $ discount with multiple pet discount · Free 24/7 lost. ASPCA® Pet Health Insurance is dedicated to finding the best pet insurance coverage for you. Compare pet insurance plans online. Get a free quote today! Discover comprehensive coverage and peace of mind for your furry friend with Petco's Pet Health Insurance. Get customizable plans, reliable protection. Pet insurance from Embrace saves you up to 90% back on vet bills from unexpected illness and medical expenses. From dog and cat insurance to wellness. Use this guide to learn about a few options, then compare quotes through our partner Fletch to discover what works best for your pet's breed, age, and location. Pets Best offers pet insurance plans for dogs and cats covering up to 90% of your unexpected veterinary costs with no annual or lifetime payout limits and. Cat Insurance. A MetLife Pet Insurance policy for cats can help protect your bundle of fluff and your wallet from cat-astrophes. Starting at $9/month. Progressive Cat Insurance by Pets Best offers plans that help make expensive vet bills for accidents and illnesses more affordable. Embrace Pet Insurance · Pets Best Pet Insurance · ASPCA Pet Health Insurance; Pumpkin Pet Insurance; Fetch by the Dodo (previously Petplan) · Figo Pet Insurance. Best pet insurance of · $3+ discount per month with annual billing · day free trial · Up to $ discount with multiple pet discount · Free 24/7 lost. ASPCA® Pet Health Insurance is dedicated to finding the best pet insurance coverage for you. Compare pet insurance plans online. Get a free quote today! Discover comprehensive coverage and peace of mind for your furry friend with Petco's Pet Health Insurance. Get customizable plans, reliable protection. Pet insurance from Embrace saves you up to 90% back on vet bills from unexpected illness and medical expenses. From dog and cat insurance to wellness. Use this guide to learn about a few options, then compare quotes through our partner Fletch to discover what works best for your pet's breed, age, and location. Pets Best offers pet insurance plans for dogs and cats covering up to 90% of your unexpected veterinary costs with no annual or lifetime payout limits and. Cat Insurance. A MetLife Pet Insurance policy for cats can help protect your bundle of fluff and your wallet from cat-astrophes. Starting at $9/month. Progressive Cat Insurance by Pets Best offers plans that help make expensive vet bills for accidents and illnesses more affordable.

Cat insurance is a type of pet insurance policy designed to cover veterinary expenses related to illnesses, injuries, and sometimes routine wellness care for. Embrace Pet Insurance was named the top Pet Insurance Provider by Forbes in The company reports that it paid out 92% of the claims submitted in and. Spot Pet Insurance offers accident and illness and accident-only coverage for cats and dogs. It has a variety of choices of reimbursement rates, annual limits. AKC Pet Insurance offers the industry's best pre-existing condition coverage for curable and incurable conditions after days of continuous coverage. AKC. Get the best pet insurance for your pets through GEICO. Protect your family today with dog insurance & cat insurance! Nationwide is our top pick for pet insurance because it has a long history of providing pet insurance and paying out claims. We cover prescription medicines like antibiotics and insulin, as well as non-prescription vitamins and nutraceuticals, when they're recommended by a vet to. Trupanion wants to help every breed of dog live a great life, with coverage for playful pups and shaggy seniors alike. No payout limits. Enjoy unlimited payouts. Pets Best offers Accident Only plans designed for those on a limited budget that want great coverage for things like broken legs, snake bites, accidental. What's the best pet insurance coverage for your pet and budget? View side-by-side plan details and see how different pet insurance companies compare. We are an affiliate site that allows users to browse, compare and read reviews from the top pet insurance providers. For pet insurance, this would include any deductibles as well as any procedures and services not covered by your plan. Learn More. Most insurance for dogs and cats allows you to use any licensed veterinarian within the US and Canada, so you don't have to worry about finding a vet who. Get affordable insurance for your dog or cat through USAA. Find out Get the protection your best friend deserves. Keep your furry family member. Why People Think Embrace is the Best Pet Insurance. We understand the emotional connection pet owners have with their dogs and cats. Our team of real pet. Our cat insurance plans help you prepare for unexpected vet bills. Get accident, illness, pre-existing condition & wellness coverage for cats of all ages. Veterinary medicine can do amazing things for pets these days, but the costs for scans and other treatments can quickly add up. Allstate pet health insurance. Bivvy is pet insurance done right and at a price that you can afford. Protect your dog or cat with Bivvy's low-cost coverage! Learn why Bivvy is the best. Get reimbursed on your pet's eligible vet bills As a union member, you get up to 10% off monthly premiums. Pets Best offers flexible coverage options, with. Is Petted an insurance provider? No, Petted is not an insurer. We're a family of pet owners like you that have put together this website so you can impartially.