ccvediogames.online Market

Market

Age To Qualify For Eitc

Check if you qualify for CalEITC · You're at least 18 years old or have a qualifying child · You have earned income within certain limits. To qualify for EITC, you must: have earned income from working for someone meet basic rules on income, a qualifying child, age, etc. If you qualify. Be at least age 18 by the end of Note: This now includes taxpayers ages and 65 and older without a qualifying child. Be a U.S. citizen or a. Taxpayers who are 18 to 24 years of age, have no qualifying children, and are otherwise qualified for the federal earned income tax credit may also be eligible. As a rule, for Indiana EIC purposes, you will be able to claim as a qualifying dependent a child who meets the age, residency, joint federal return, and. A qualifying child must be under age 17 and a U.S. citizen, national or a U.S. resident. Earned Income Tax Credit. A qualifying child does not have to meet the. with an Individual Taxpayer Identification Number (ITIN), or · without a qualifying child and is at least age 18 or older (including taxpayers over ages 65). The EITC is available to workers with low to moderate incomes. The income limit depends on the number of qualifying children and on whether the tax filer is. Worker's Age: You must be between the ages of 25 and 64 if you are not claiming children. Qualifying Child Without a Social Security Number: You can claim the. Check if you qualify for CalEITC · You're at least 18 years old or have a qualifying child · You have earned income within certain limits. To qualify for EITC, you must: have earned income from working for someone meet basic rules on income, a qualifying child, age, etc. If you qualify. Be at least age 18 by the end of Note: This now includes taxpayers ages and 65 and older without a qualifying child. Be a U.S. citizen or a. Taxpayers who are 18 to 24 years of age, have no qualifying children, and are otherwise qualified for the federal earned income tax credit may also be eligible. As a rule, for Indiana EIC purposes, you will be able to claim as a qualifying dependent a child who meets the age, residency, joint federal return, and. A qualifying child must be under age 17 and a U.S. citizen, national or a U.S. resident. Earned Income Tax Credit. A qualifying child does not have to meet the. with an Individual Taxpayer Identification Number (ITIN), or · without a qualifying child and is at least age 18 or older (including taxpayers over ages 65). The EITC is available to workers with low to moderate incomes. The income limit depends on the number of qualifying children and on whether the tax filer is. Worker's Age: You must be between the ages of 25 and 64 if you are not claiming children. Qualifying Child Without a Social Security Number: You can claim the.

Workers who receive long-term, employer-paid disability benefits and are under the minimum retirement age can qualify for the EITC and CTC, even if they didn't. Taxpayers who are 18 to 24 years of age, have no qualifying children, and are otherwise qualified for the federal earned income tax credit may also be eligible. earned income tax credit (EITC) equal a To claim the federal credit, a taxpayer must either be 25 years old or have at least one qualifying child; the age. The Earned Income Tax Credit (EITC) helps low-to-moderate income workers and families get a tax break. Answer some questions to see if you qualify. For the tax year, young adults ages are now temporarily eligible for the EITC. The American Rescue Plan has helped make the following temporary. Can I Get Free Tax Help? · Your income is $60, or less · You are a person with a disability · You speak limited or no English · You are age 60 or older. Either you or your spouse (if filing a joint return) must be at least age 25 but under age 65; and If you qualify for the federal EITC, you also qualify for. If your child is permanently and totally disabled, the child can be any age, even an adult. According to the IRS, a person is considered “permanently and. Eligible exemptions include personal exemptions only. You may not claim this credit if you also claim additional exemptions for blindness or age. To claim. Your qualifying child must be under 19 or a full-time student under 24 and must be younger than you (or your spouse, if filing jointly). If your child is. You qualify for the EITC as long as you were at least 25 but younger than 65 on December 31 of the tax year, you earned income through work, and you meet the. Low-income adults with no children are eligible. For a person or couple to claim one or more persons as their qualifying child, requirements such as. To claim EITC you must file a tax return, even if you do not owe any tax or are not required to file. If you have a qualifying child, you must file the Schedule. 1 qualifying child: $3,; 2 qualifying children: $5,; 3 or more qualifying children: $6, Are there other requirements besides earned income to qualify. You must be at least age 25 but under age 65 (at least one spouse must meet the age rule). You must sign in to vote. Found what you need? Start my taxes. Must be at least age. 25 but under age Filing status cannot be. “married filing separately.” Must have earned income. Qualifying child. CT Earned Income Tax Credit · Meets all the basic qualifying rules under Do I Qualify? · You (or your spouse if filing jointly) must be at least age 25 but under. Are at least 25 and under 65 years of age OR have a qualifying child in Filed a federal tax return. Eligible to claim the federal Earned Income Tax. Starting with tax year , this credit may be available if you do not have qualifying children, but you have a work-eligible SSN and meet the requirements for.

Jewelry As An Investment

Jewellery's Long-term Value as an Investment. Jewellery is not just a symbol of love; Investing in jewelry can grow in value over the years. The jewellery. You might assume high-end gems and jewelry make good investments, but that's not necessarily the case. Gems of lesser value often appreciate more and are. Jewelry can be used as collateral for loans. If you ever need to borrow money, using your jewelry as collateral can get you a lower interest rate than other. 18k gold jewellery contains 25% metal alloy to make them fairly durable, they have 75% pure gold, making them good gold investments. However, it's wise not to get carried away while buying the precious yellow metal. There are many ways to invest in gold. You can either buy gold directly or in. Investment powders and equipment to help prepare jewelry molds, waxes, and CAD pieces for casting. Jewelry is argued to be a wise investment in this blog article by highlighting its potential for appreciation over time. Diamond jewellery as investment offers a lot of opportunities provided you do your homework. They are beautiful investment options as long as you don't buy. We invite you to invest in the sustainable stability of Platinum and 24 karat Gold jewellery. Jewellery's Long-term Value as an Investment. Jewellery is not just a symbol of love; Investing in jewelry can grow in value over the years. The jewellery. You might assume high-end gems and jewelry make good investments, but that's not necessarily the case. Gems of lesser value often appreciate more and are. Jewelry can be used as collateral for loans. If you ever need to borrow money, using your jewelry as collateral can get you a lower interest rate than other. 18k gold jewellery contains 25% metal alloy to make them fairly durable, they have 75% pure gold, making them good gold investments. However, it's wise not to get carried away while buying the precious yellow metal. There are many ways to invest in gold. You can either buy gold directly or in. Investment powders and equipment to help prepare jewelry molds, waxes, and CAD pieces for casting. Jewelry is argued to be a wise investment in this blog article by highlighting its potential for appreciation over time. Diamond jewellery as investment offers a lot of opportunities provided you do your homework. They are beautiful investment options as long as you don't buy. We invite you to invest in the sustainable stability of Platinum and 24 karat Gold jewellery.

With our 22K and 24K gold investment jewelry, engage in classic style. Perk up your investment portfolio with the allure and strength of precious metal. a true premium gypsum bonded investment developed and perfected for the casting of High Karat Gold (18K and above Yellow & White) and especially for casting. Personally, I believe these companies make great investment opportunities, especially when risk is taken into account. With our 22K and 24K gold investment jewelry, engage in classic style. Perk up your investment portfolio with the allure and strength of precious metal. Investing in diamond jewelry itself is also a good way to diversify your overall investment portfolio. Acquiring physical investments like diamonds and precious. Gold Investment Jewelry k 14k 18k 22k 24k Solid karat gold jewelry Great prices, no big markups. In this ultimate guide we will explore the details of investing in gold jewellery, knowledge about its market and decide wisely to boost up your financial. Making your diamond jewellery an investment option isn't such a bad idea as diamonds are known to offer good returns, and they have seen a price increase in. The cons of investing in gold jewelry · Higher initial investment · Market volatility · Liquidity concerns · It's vulnerable to physical damage. Bullion historically maintains its value, which is directly correlated with precious metal prices, making it a stable investment choice. Jewelry is valuable and will hold value if it contains precious metals or diamonds and gems or perhaps is made by someone well known and is “one. Discover At Present's collection of unique investment jewelry, featuring one-of-a-kind designer pieces you won't find anywhere else. Investment waste may be hazardous if it contains silica dust or metallic “fine powders 1 ” that are harmful to human health and the environment. Is Gold Jewelry a Good Investment? · All Gold Products Include a Premium · Jewelry Premiums Are Higher Than Bullion · Bullion Offers Better Liquidity and Resale. Developed for precious metals with high melting point. (this product requires ml Invest Liquid per kilo investment powder). 5 kg bag in transport box. BUILDING YOUR JEWELRY WARDROBE: THE INVESTMENT PIECES. Part Three of Building Your Jewelry Wardrobe—the investment pieces! These are the big players in your. Invest in gold for a diversified portfolio. Whether you're looking to buy 24k gold necklaces, earrings, bracelets, or gold rings, Laurea helps you build. Stories is your go-to for the latest news and features from Harrods, including A Fine Investment: The Jewellery Pieces to Collect. Menē crafts 24 karat gold and platinum investment jewelry™ transparently sold by gram weight, restoring the tradition of jewelry as a store of enduring.

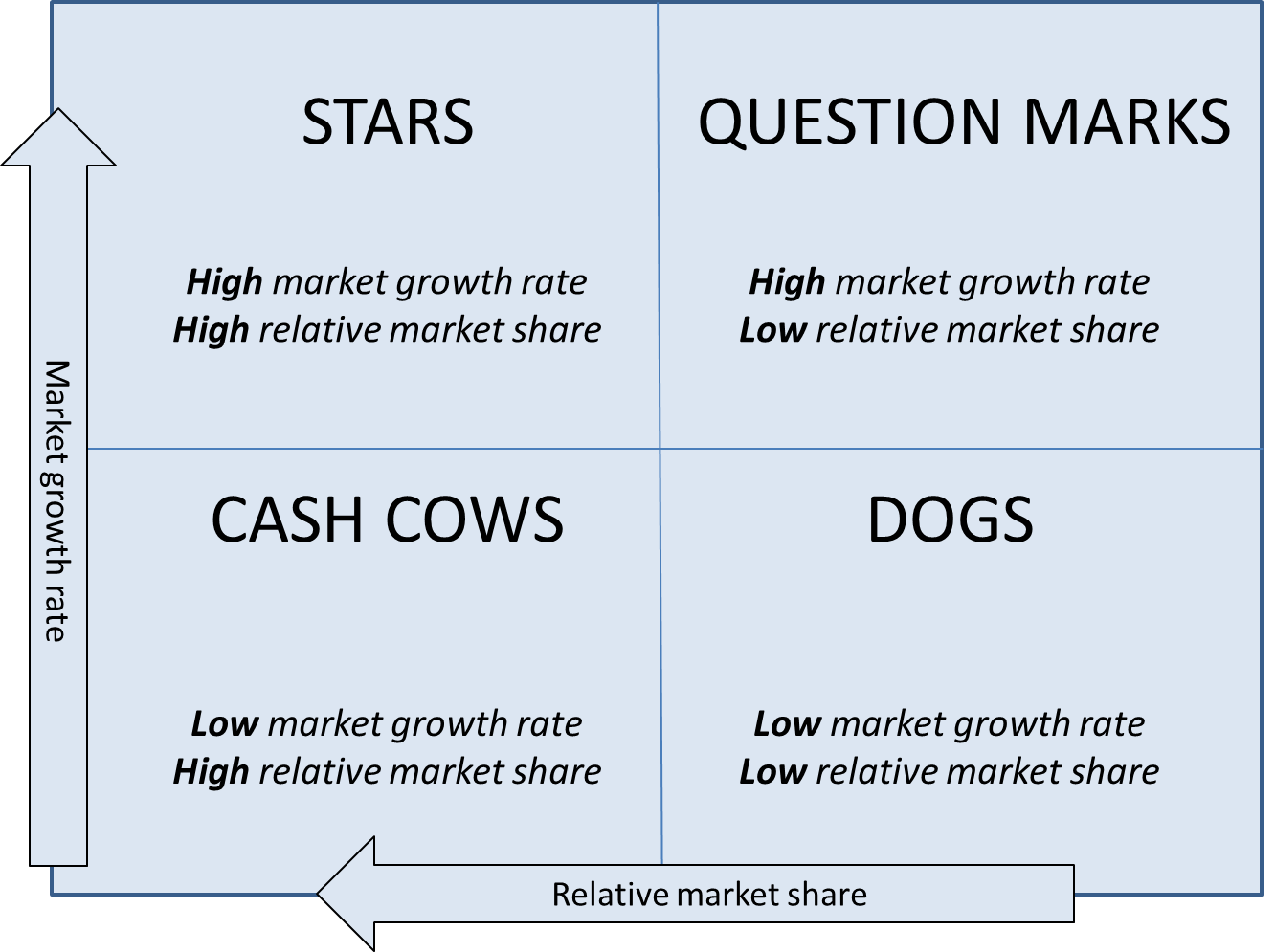

Boston Consulting Group Matrix

The matrix classifies products into four categories based on their market share and the market growth rate. The composition of the portfolio can be critical to the growth and success of the company. The BCG matrix considers two variables, namely.. x MARKET GROWTH RATE. The BCG Matrix is one of the most popular portfolio analysis methods. It classifies a firm's product and/or services into a two-by-two matrix. Each quadrant is. The BCG Matrix is one of the most popular methods of portfolio planning. The concept reviews the components of the matrix and examines their strategic. The BCG matrix (sometimes called the Growth-Share matrix) was created in by Bruce Henderson and the Boston Consulting Group to help companies with many. The composition of the portfolio can be critical to the growth and success of the company. The BCG matrix considers two variables, namely.. x MARKET GROWTH RATE. Designed to help with strategic long term planning, the Boston Consulting Group Matrix (BCG) was created in to assess products on two dimensions. The Boston Consulting Group's item portfolio matrix (BCG matrix), otherwise called the Growth/Share Matrix, is a vital arranging device that enables a business. A BCG matrix is a model used to analyze a business's products to aid with long-term strategic planning. The matrix classifies products into four categories based on their market share and the market growth rate. The composition of the portfolio can be critical to the growth and success of the company. The BCG matrix considers two variables, namely.. x MARKET GROWTH RATE. The BCG Matrix is one of the most popular portfolio analysis methods. It classifies a firm's product and/or services into a two-by-two matrix. Each quadrant is. The BCG Matrix is one of the most popular methods of portfolio planning. The concept reviews the components of the matrix and examines their strategic. The BCG matrix (sometimes called the Growth-Share matrix) was created in by Bruce Henderson and the Boston Consulting Group to help companies with many. The composition of the portfolio can be critical to the growth and success of the company. The BCG matrix considers two variables, namely.. x MARKET GROWTH RATE. Designed to help with strategic long term planning, the Boston Consulting Group Matrix (BCG) was created in to assess products on two dimensions. The Boston Consulting Group's item portfolio matrix (BCG matrix), otherwise called the Growth/Share Matrix, is a vital arranging device that enables a business. A BCG matrix is a model used to analyze a business's products to aid with long-term strategic planning.

Download ready-to-use BCG (Boston Consulting Group) Growth-Share Matrix Templates and models made by Strategy Consultants, Strategy consulting firms and. Download ready-to-use BCG (Boston Consulting Group) Growth-Share Matrix Templates and models made by Strategy Consultants, Strategy consulting firms and. Developed by the Boston Consulting Group in the s, the BCG matrix is a tool that helps you prioritize and categorize products based on the market growth. This technique became a staple of market strategies in the s. In the Boston matrix products are classified according to their ability to either generate or. The purpose of this matrix is to help corporations to analyze their business units, that is, their product lines. The Boston Matrix is a model which helps businesses analyse their A portfolio of products can be analysed using the Boston Group Consulting Matrix. The Boston Consulting Group matrix makes it easy for you to review your products and compare one another. It helps you focus on products that are worth the time. The Boston Consulting Group developed another, much less widely reported, matrix which approached the economies of scale decision rather more directly. The BCG Growth-Share Matrix is a portfolio planning model developed by Bruce Henderson of the Boston Consulting Group in the early 's. This technique became a staple of market strategies in the s. In the Boston matrix products are classified according to their ability to either generate or. The Boston Consulting Group matrix, which incorporates the concept of the product life cycle, is a useful tool which helps management teams to assess existing. An example of how the BCG matrix can be used would be two companies competing in the same industry. Company A has a large market share but is not growing as. The BCG Matrix, also known as the Growth-Share Matrix, is a visual representation of a company's portfolio of products or business units. The BCG Matrix, also known as the Boston Consulting Group Matrix, is a strategic tool used by businesses to evaluate their product lines and determine where. The Boston Consulting Group Growth Share Matrix is a strategic tool for allocating resources among business units or products. It categorizes them as stars. The Boston Consulting Group growth-share matrix is an interesting tool for product management. Unlike most agile and lean tools, it focuses on business value. Developed by the Boston Consulting Group in the s, the BCG matrix is a tool that helps you prioritize and categorize products based on the market growth. It is a four-quadrant matrix that classifies a company's business units or products based on their market share and market growth rate. The BCG Matrix is one of the most popular methods of portfolio planning. The concept reviews the components of the matrix and examines their strategic. The Boston Consulting Group (BCG) matrix is a visual marketing management tool used to analyse a firm's product portfolio. For example, Apple's product.

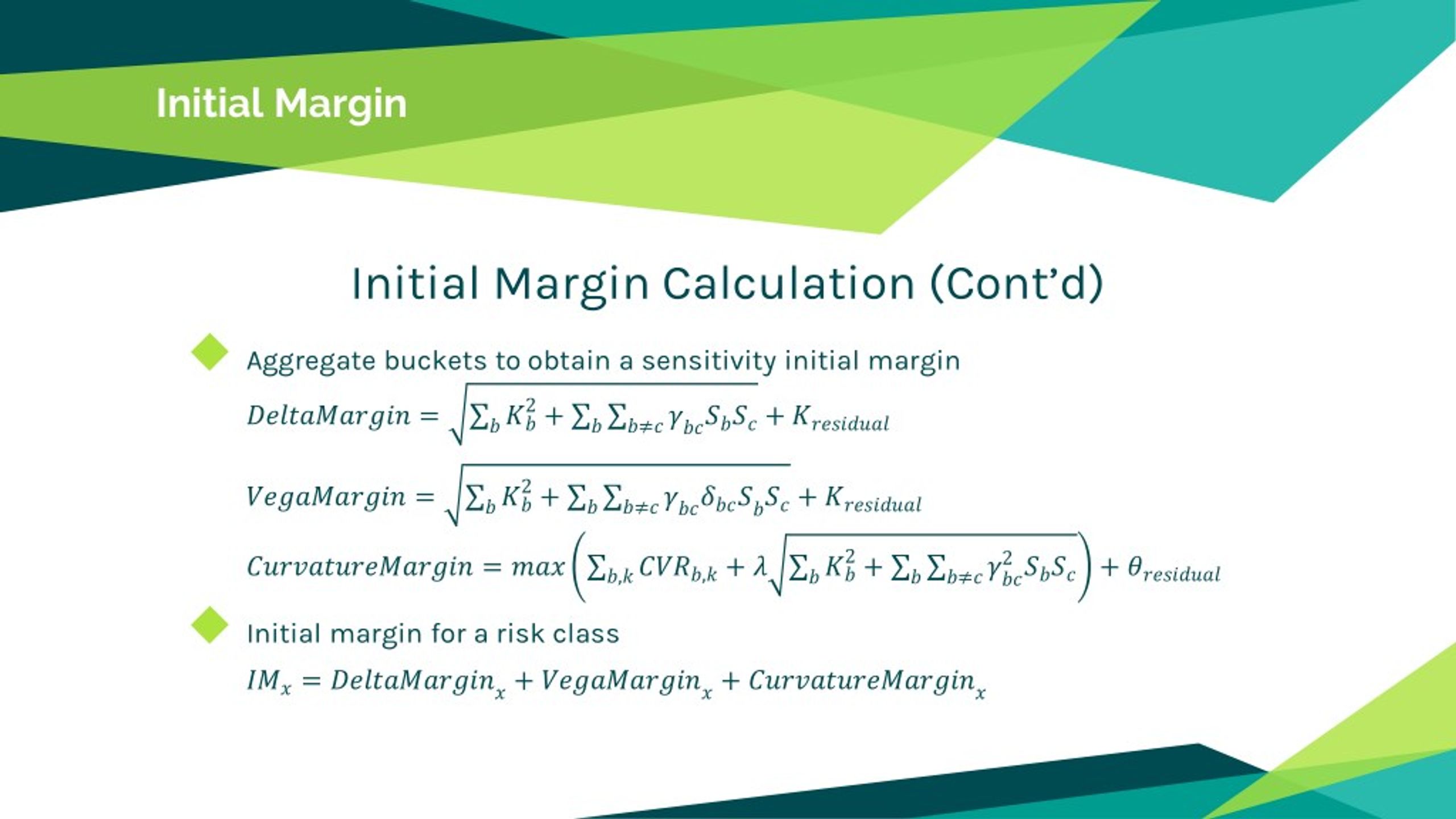

Initial Margin Rules

Phase 6 represents the final stage of the phase-in of the rules for regulatory initial margin (Reg IM). Earlier phases are discussed in our previous notes. The Uncleared Margin Rules require counterparties in non-cleared over-the-counter (OTC) derivative trades to exchange initial margin (IM) and variation margin. Initial margin requirements will be phased-in, but at the end of the phase-in period there will be a minimum level of non-centrally cleared derivatives. As of the close of business on each business day, the member shall compute an amount (the “Initial Margin Requirement”) for each Uncleared SBS Account equal to. The overall liquidity burden resulting from initial margin requirements, as well as the availability of eligible collateral to satisfy such requirements, in. Initial margin refers to the percentage of equity a margin account holder must contribute to the purchase of securities. In other words, initial margin. To date, the firms subject to the regulatory obligation to exchange initial margin on uncleared over-the-counter (OTC) derivatives. Standardised initial margin schedule ; Equity. 15 ; Foreign exchange. 6 ; Interest rate: 0–2 year duration. 1 ; Interest rate: 2–5 year duration. 2. Each September until , increasing numbers of entities will be required to meet initial margin regulations as the threshold level for compliance reduces. Phase 6 represents the final stage of the phase-in of the rules for regulatory initial margin (Reg IM). Earlier phases are discussed in our previous notes. The Uncleared Margin Rules require counterparties in non-cleared over-the-counter (OTC) derivative trades to exchange initial margin (IM) and variation margin. Initial margin requirements will be phased-in, but at the end of the phase-in period there will be a minimum level of non-centrally cleared derivatives. As of the close of business on each business day, the member shall compute an amount (the “Initial Margin Requirement”) for each Uncleared SBS Account equal to. The overall liquidity burden resulting from initial margin requirements, as well as the availability of eligible collateral to satisfy such requirements, in. Initial margin refers to the percentage of equity a margin account holder must contribute to the purchase of securities. In other words, initial margin. To date, the firms subject to the regulatory obligation to exchange initial margin on uncleared over-the-counter (OTC) derivatives. Standardised initial margin schedule ; Equity. 15 ; Foreign exchange. 6 ; Interest rate: 0–2 year duration. 1 ; Interest rate: 2–5 year duration. 2. Each September until , increasing numbers of entities will be required to meet initial margin regulations as the threshold level for compliance reduces.

Initial margin is collateral collected by a counterparty and posted on a two-way basis (each party posts and receives at the same time) to minimize current and. The regulations stipulate that regulatory initial margin needs to be segregated with an entity independent from the posting party (or, for some regimes. The initial margin requirement refers to the amount of cash, securities, or other collateral that needs to be deposited into a margin account before it may be. Variation margin means collateral provided by one party to its counterparty to meet the performance of its obligations under one or more non-cleared swaps or. Initial margin (IM) is collateral collected and/or posted to reduce future exposure to a given counterparty as a result of non-cleared derivative activity. The initial implementation of Variation Margin (VM) requirements was implemented in , while Initial Margin (IM) requirements continue to be phased in until. In derivatives markets, initial margin is one of two types of collateral required to protect a party to a contract in the event of default by the other. The Uncleared Margin Requirements require swap dealers, major swap participants, and certain financial end users with material swaps exposure to post both. The Federal Reserve Board's Regulation T sets the minimum initial margin at 50%, meaning investors trading on a margin account must have cash or collateral to. Such initial margin shall be in an amount at least as large as the covered swap entity would be required to collect under paragraph (a) of this section if it. Initial margin must be exchanged where the amount of margin required on a consolidated basis exceeds an agreed threshold amount (the Rules allow a maximum. Calculation methodology: two methodologies are available: (i) “grid” – set out in the Margin RTS under UK and EU margin rules; or (ii) ISDA SIMM (which. Initial margin is collateral collected by a counterparty and posted on a two-way basis (each party posts and receives at the same time) to minimize current and. Standardised initial margin schedule ; Equity. 15 ; Foreign exchange. 6 ; Interest rate: 0–2 year duration. 1 ; Interest rate: 2–5 year duration. 2. An Initial Margin Requirement refers to the percentage of equity required when an investor opens a position. For example, if you have $5, and would like to. The regulatory margin requirements introduce a two-way exchange of initial margin (IM) and variation margin (VM) among entities in-scope of the margin rules. Initial margin collateral acts as an additional cushion to protect against volatility between the time a party's exposure is calculated and the time collateral. The mandatory exchange of initial margin for uncleared derivatives under BCBS/IOSCO guidelines is driving the requirement for accurate and fast margin. Initial margin collateral acts as an additional cushion to protect against volatility between the time a party's exposure is calculated and the time collateral. What collateral will be eligible? ▫ The Margin Rules are broadly permissive of any asset approved by national regulators for both initial margin (Where.

How Mortgage Companies Make Money

Interest: Reverse mortgages are loans, so lenders make money on the interest that accrues on the loan balance. Money and credit · Travel · Voting and elections · Home · Complaints · Housing Fees for services the mortgage company didn't provide; Illegal tactics to. Lenders make money upfront on mortgages through origination fees, which are typically a percentage of the loan amount. They may also charge discount points. In summary, there's a lot of money to be made on mortgages at different steps along the way. First, loan officers and mortgage brokers can make commissions on a. Lenders make money from origination fees, yield spread premiums, discount points, closing costs, mortgage-backed securities (MBS), and loan servicing. The lender holding both mortgages now has a powerful incentive to foreclose because that is the only way to get repaid on the second mortgage. A mortgage companies makes money from the fees it charges to fund your mortgage, once they have done that, they can sell on the mortgage and do. Learn how to adjust shopping strategies, make sure that listing price is right, and earn cash poolside. Better is a family of companies serving all your. Mortgage servicing companies generally receive a fee paid out from each loan that they service. The amount of the fee usually depends on the type of loan the. Interest: Reverse mortgages are loans, so lenders make money on the interest that accrues on the loan balance. Money and credit · Travel · Voting and elections · Home · Complaints · Housing Fees for services the mortgage company didn't provide; Illegal tactics to. Lenders make money upfront on mortgages through origination fees, which are typically a percentage of the loan amount. They may also charge discount points. In summary, there's a lot of money to be made on mortgages at different steps along the way. First, loan officers and mortgage brokers can make commissions on a. Lenders make money from origination fees, yield spread premiums, discount points, closing costs, mortgage-backed securities (MBS), and loan servicing. The lender holding both mortgages now has a powerful incentive to foreclose because that is the only way to get repaid on the second mortgage. A mortgage companies makes money from the fees it charges to fund your mortgage, once they have done that, they can sell on the mortgage and do. Learn how to adjust shopping strategies, make sure that listing price is right, and earn cash poolside. Better is a family of companies serving all your. Mortgage servicing companies generally receive a fee paid out from each loan that they service. The amount of the fee usually depends on the type of loan the.

Typically, a lender will give you a set amount of money based on the value of the home you want to buy or own. You agree to make payments over an agreed-upon. Fannie Mae and Freddie Mac buy mortgages from lenders and either hold these mortgages in their portfolios or package the loans into mortgage-backed securities . Lenders love clients that are on a salaried income because it's much easier to verify for Fannie Mae, Freddie Mac, or FHA. When you're on a commission income. The term Net Interest Margin is often used in conjunction with mortgage profit compression. Also known as NIM, it has 2 important components - interest income. When lenders sell loans, they're able to take this debt from their balance sheet and free up their credit for new customers. The second reason lenders sell. Mortgage companies don't usually retain the loans they make. They typically package them into securities and sell them to investors. The. mortgage lender to an ecosystem of businesses that create new opportunities for our clients. Here are the businesses that make up Rocket Companies. Home. An escrow account is where you set aside money to pay insurance and taxes. The account is managed by the servicer, who ensures that the lender knows the money. makes loans to or finances purchases on behalf of consumers money laundering that involved both banks and residential mortgage lenders and originators. Lender Sells Your Loan · Investors Buy Shares of Pooled Mortgages · You Make Mortgage Payments · Investors Receive Income. In a nutshell, selling loans is more profitable than holding onto them. Banks can make money by writing a mortgage and then collecting the interest on it for. Interest: Reverse mortgages are loans, so lenders make money on the interest that accrues on the loan balance. Where money comes from. Mortgage companies do not manufacture money because they are not depositories. They don't have customers opening up checking and savings. How do I obtain a license to operate as a broker or lender in the residential mortgage industry? Mortgage closing costs. These are expenses charged by a lender to make or originate your loan. They typically include origination fees, discount points, fees. Lenders typically sell loans for two reasons. The first is to free up capital that can be used to make loans to other borrowers. A home loan often involves many fees, such as loan origination fee or commitment fee, broker fee and closing costs. Some fees are paid when you apply for a loan. I am a “hard money” lender and all of the loans I make are to investors for the purchase and rehab of single family residences. After the rehab is completed. Mortgage brokers generate revenue only when they produce loans. All expenses, such as loan officer commissions, office overhead, and marketing/advertising, are. The banks will lend the money out to borrowers, charging the borrowers a higher interest rate and profiting off the interest rate spread. How Do Banks Make.

Level 2 Charger Tax Credit

PUD Level 2 EV Charger Rebate - Save up to $! A Level 1 volt charger is supplied with most new EVs and plugs into a standard wall outlet. Level 2. New EVs may be eligible for a federal income tax credit of up to $7, The federal tax incentive is not applied at the point of purchase but may be claimed on. Here's how to claim your credit for 30% of the cost of your Level 2 AC (volt) home charger and installation, up to $1, 1. Determine eligibility. Use. Central Lincoln PUD — CLPUD customers can receive a $ rebate for installing a Level 2 electric vehicle charger. Residential, commercial, and industrial. Claim a rebate from TEP of up to $ on EV chargers. TEP residential customers who purchase a networked* Level 2 electric vehicle (EV) charger can claim a. The Electric Vehicle Charging Equipment Rebate Program provides rebates for Level 2 electric vehicle charging stations purchased and installed after May 1, Federal incentives include a 30% tax credit up to $1, for electric car chargers and installation costs. The tax credit extends through Dec. Residential customers may receive a rebate of up to $ to purchase and install a Level 2 charging station. Commercial or multi-unit dwelling customers may. The federal government offers a tax credit of 30% off the purchase and installation of at-home Level 2 charging, up to $1, To learn more, click here(opens. PUD Level 2 EV Charger Rebate - Save up to $! A Level 1 volt charger is supplied with most new EVs and plugs into a standard wall outlet. Level 2. New EVs may be eligible for a federal income tax credit of up to $7, The federal tax incentive is not applied at the point of purchase but may be claimed on. Here's how to claim your credit for 30% of the cost of your Level 2 AC (volt) home charger and installation, up to $1, 1. Determine eligibility. Use. Central Lincoln PUD — CLPUD customers can receive a $ rebate for installing a Level 2 electric vehicle charger. Residential, commercial, and industrial. Claim a rebate from TEP of up to $ on EV chargers. TEP residential customers who purchase a networked* Level 2 electric vehicle (EV) charger can claim a. The Electric Vehicle Charging Equipment Rebate Program provides rebates for Level 2 electric vehicle charging stations purchased and installed after May 1, Federal incentives include a 30% tax credit up to $1, for electric car chargers and installation costs. The tax credit extends through Dec. Residential customers may receive a rebate of up to $ to purchase and install a Level 2 charging station. Commercial or multi-unit dwelling customers may. The federal government offers a tax credit of 30% off the purchase and installation of at-home Level 2 charging, up to $1, To learn more, click here(opens.

Charge Ready NY This program offers incentives to public, private and not-for-profit organizations that install Level 2 EV charging stations at workplaces. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. It covers 30% of the costs with a maximum $1, credit. See if you're eligible for up to $ in EV rebates for purchasing and installing a Level 2 Charger in your home. Check out the specifics here. Federal EV Tax. Lower the price tag of an electric vehicle by combining rebates and Inflation Reduction Act tax credits. · Charge your vehicle from the comfort of your own home. Residents can receive up to $ for the purchase and installation an eligible Level 2 charger (models listed below). Residents and businesses may also qualify. $ incentive for the installation “commercial” Level 2 charger intended for: tax credit of 30% of the cost of installing EV charging equipment. If. Alternative Fuel Infrastructure Tax Credit · 6% of the depreciable costs, up to $, per item; or, · 30% of the depreciable costs, up to $, per item, if. A critical component of owning an EV is charging it. While you can charge your vehicle with a standard volt outlet, a volt Level 2 home Electric Vehicle. The standard Level 2 charger rebate is $ Customers with qualifying household incomes are eligible for a $ rebate and up to percent or $2, of the. Level 2 Charger 75% of charger cost and/or installation cost up to $ Maximum incentive per charger will not exceed $ Limit of one charger per vehicle. provides a tax credit for up to 30% of the total cost of installing an electric vehicle (EV) charger at your home. The tax credit is capped at $1, Customers who purchase and install EV chargers can receive up to $4, per handle for each level 2 EV charger. The U.S. Federal Tax Credit gives individuals. Get up to $, capped at 75% of total costs, for level 2 home charging equipment. Rebates & Eligibility; Requirements; Apply Online. REBATES. Hardwired level 2. Program Description: The Electric Vehicle Supply Equipment (EVSE) Rebate Program provides funding assistance for eligible costs incurred acquiring and. Rebate is for the invoiced cost of a licensed electrician to install wiring and panel upgrades for an NEMA outlet for a Level 2 electric vehicle charger. Consumers who purchase qualified residential charging equipment may receive a tax credit of 30% of the cost, up to $1, Consult a tax professional to see if. QUALIFIES FOR REBATES AND INCENTIVES. Qualifies for Federal alternative fuel tax credit for 30% of the cost of the charger and installation (up to $1,). The rebate provided will be $ or the amount of documented, eligible charging system expenditures, whichever is less. Q: I already have a volt circuit and. The federal government, for example, offers a tax credit of up to $7, for an electric vehicle purchase. Pepco offers EV charger rebates and other incentives. With the Charge Ready Home Rebate Program, you can qualify for up to $4, in rebates if you install a Level 2 (L2) EV charger within days of getting your.

Columbia University Online Degrees

View all Programs including Associates, Bachelor's, Master's Doctorates, and Certifications! Call Columbia Southern University at to explore. Online Learning · Records Change of Major-Degree Change of Major-Certificate · Study Abroad · Transcript Request · Tutoring. ToggleCampus Life. four students. Fully Online · Master of Science Programs · Applied Analytics · Bioethics · Enterprise Risk Management · Human Capital Management · Nonprofit Management. Lower Columbia College is an accredited, public, two-year community and technical college offering associate degrees, certificates, workforce training. The university's more than 50 online graduate and post-graduate options Medicine (Columbia) · Medicine (Greenville) · Music · Nursing · Pharmacy · Public. Join Columbia College and the League of Women's Voters to learn about the role and importance of the Constitution as well as check your voter registration. Find your perfect program match by exploring our diverse range of certificates, undergraduate, graduate, and online degrees designed to meet the needs and. Online learning at Teachers College, Columbia University is meaningful curriculum that addresses a variety of academic interests and career goals. Online Programs Rankings · #1. in Best Online Master's in Information Technology Programs (tie) · #8. in Best Online Master's in Engineering Programs (tie) · #3. View all Programs including Associates, Bachelor's, Master's Doctorates, and Certifications! Call Columbia Southern University at to explore. Online Learning · Records Change of Major-Degree Change of Major-Certificate · Study Abroad · Transcript Request · Tutoring. ToggleCampus Life. four students. Fully Online · Master of Science Programs · Applied Analytics · Bioethics · Enterprise Risk Management · Human Capital Management · Nonprofit Management. Lower Columbia College is an accredited, public, two-year community and technical college offering associate degrees, certificates, workforce training. The university's more than 50 online graduate and post-graduate options Medicine (Columbia) · Medicine (Greenville) · Music · Nursing · Pharmacy · Public. Join Columbia College and the League of Women's Voters to learn about the role and importance of the Constitution as well as check your voter registration. Find your perfect program match by exploring our diverse range of certificates, undergraduate, graduate, and online degrees designed to meet the needs and. Online learning at Teachers College, Columbia University is meaningful curriculum that addresses a variety of academic interests and career goals. Online Programs Rankings · #1. in Best Online Master's in Information Technology Programs (tie) · #8. in Best Online Master's in Engineering Programs (tie) · #3.

Get a % online master's degree, and gain expertise for a lifetime. We give you the flexibility to advance your career in just a year. Flexible and affordable, online learning at Lower Columbia College lets you earn your degree without a set classroom schedule. The eLearning office provides. Campuses offer flexible learning formats* including: on-campus, virtual instructions, and online courses. *Clinical, practicum, and externship requirements. WebColumbia Business School. Columbia Business School Executive Education offers online programs that deliver immediate and sustainable skills. Get your bachelor's degree on your schedule with our online and evening options. Our % online degrees are top-ranked by U.S. News & World Reports. Transfer to a University Fast Facts About Columbia Basin College. Average Annual Tuition. Student to Faculty Ratio. +. Programs & Degrees. Discover courses and programs offered by Columbia University. Explore various fields and disciplines taught by Columbia faculty, and find the perfect program. Degree Programs · Business School Executive MBA Program · Business School MBA Program · Climate and Society, Master of Arts Program in · Combined Plan () Program. Columbia University Online Courses: Top-Rated Ones · Financial Engineering and Risk Management · Statistical Thinking for Data Science and Analytics · Construction. Life can be unpredictable. With over 70 degrees offered % online, your education can change and adapt to your needs – no matter where life takes you. Our online programs create a forum for you to meet other executives where they are and connect with thought leadership, diverse talent, and a vast community of. For more than 25 years, CSU has helped adult learners achieve their academic goals by providing the strongest online degree programs at an affordable rate. Columbia University Website Cookie Notice. Learn more. OK. Skip navigation Jump to main navigation. Columbia University School of Professional Studies Home. Ranked #1 in South Carolina, Columbia International University offers affordable online degrees designed to fit your busy life. Free online courses from Columbia University. Columbia University is one of Teachers College, Columbia University's affiliate graduate school of education. Online Giving. Be Prepared. icon 3 · Athletics. #TheBESTofBC. icon 4 · Calendar Colleges and Universities · Read More». August 9, UNCF Award. Press. You are invited to receive the best online education in the world! Mizzou Online is founded on the world-class academic strength of the University of. Learn to thrive in a Christ centered community at a top ranked university. CIU's on-campus and online degree programs are accredited, career focused. Columbia College Chicago is a private, nonprofit college offering a distinctive curriculum that blends creative and media arts, liberal arts, and business.

Blockchain For Stock Trading

Stock market across the globe is rapidly using blockchain technology for the market transaction. Some of the country is still preparing themselves to use the. You can trade cryptos by speculating on their price movements via CFDs (contracts for difference). CFDs are leveraged derivatives. These digital stocks to act similar to digital currency whose price is real time and fluctuates. Stocks exchanged completely peer- -peer could resolve many of. Blockchain companies. Find the best Blockchain Stocks to buy Related Stock Lists: Bitcoin Cryptocurrency Exchange Traded Fund Decentralization Exchange. Buy and sell bitcoin, ethereum, and litecoin in the same app where you trade stocks—for as little as $1. All with a leader in crypto for nearly a decade. The Securities and Exchange Commission charged Coinbase, Inc. with operating its crypto asset trading platform as an unregistered national securities exchange. Buy an ETF that specifically invests in shares of companies with exposure to blockchain. Two notable examples are Amplify Transformational Data Sharing ETF . Blockchain Stocks ; COIN COINBASE · ; MARA MARATHON DIGITAL HOLDINGS · ; CORZ CORE SCIENTIFIC · The benefits and impact of Blockchain could be far-reaching in capital markets across buy side, sell side, and market infrastructure. Stock market across the globe is rapidly using blockchain technology for the market transaction. Some of the country is still preparing themselves to use the. You can trade cryptos by speculating on their price movements via CFDs (contracts for difference). CFDs are leveraged derivatives. These digital stocks to act similar to digital currency whose price is real time and fluctuates. Stocks exchanged completely peer- -peer could resolve many of. Blockchain companies. Find the best Blockchain Stocks to buy Related Stock Lists: Bitcoin Cryptocurrency Exchange Traded Fund Decentralization Exchange. Buy and sell bitcoin, ethereum, and litecoin in the same app where you trade stocks—for as little as $1. All with a leader in crypto for nearly a decade. The Securities and Exchange Commission charged Coinbase, Inc. with operating its crypto asset trading platform as an unregistered national securities exchange. Buy an ETF that specifically invests in shares of companies with exposure to blockchain. Two notable examples are Amplify Transformational Data Sharing ETF . Blockchain Stocks ; COIN COINBASE · ; MARA MARATHON DIGITAL HOLDINGS · ; CORZ CORE SCIENTIFIC · The benefits and impact of Blockchain could be far-reaching in capital markets across buy side, sell side, and market infrastructure.

Find the best blockchain Technology Stocks to buy now. Robinhood Markets (HOOD), RIOT (RIOT) and Coinbase (COIN) are some of the most trending stocks in the. Blockchain technology is widely known as the breakthrough technology underlying Bitcoin and other cryptocurrencies and digital assets. What makes blockchain. As blockchain continues to mature, it may not entirely replace stock markets but rather complement and enhance existing financial infrastructure. Crypto Trading · Staking Welcome to SIX Digital Exchange, the world's first fully regulated stock exchange and central securities depository (CSD). A blockchain is a distributed database or ledger shared among a computer network's nodes. They are best known for their crucial role in cryptocurrency systems. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange. Below is a list of the top five blockchain companies to invest in. Each of these companies uses blockchain technology in different ways. Stocks represent equity in a company, while cryptocurrencies are digital or virtual currencies using cryptography. · Both asset classes are influenced by market. E*TRADE offers ways to gain indirect exposure to popular cryptocurrencies via securities and futures. We expect to offer more investment options as the. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. Building a Decentralized Stock Market based on Blockchain Technology. Building a decentralized stock market will help eliminate unnecessary intermediaries. Whether you're eyeing blockchain stocks with explosive upside or scouting for the best blockchain stocks to buy and trade, the market is ripe with options. Another thing to consider is the absolute size difference between global stock markets and cryptocurrencies. As of , the amount of stocks outstanding. Cryptocurrency investors can buy or sell them directly in a spot market, or they can invest indirectly in a futures market or by using investment products that. stock trading and investing 3 Blockchain Stocks to Sell in August Before They Crash. ABSTRACT. This study aims to explore the benefits of implementing blockchain technology as a basis for stock trading in Indonesia to improve the corporate. API for Stock, Options, and Crypto Trading. Trade with algorithms, connect with apps, and build services with our easy to use APIs. Trade in minutes from only €1. Your No.1 European broker for stocks, crypto, indices, ETFs and precious metals. Trade 24/7. Fee-free on all deposits. You can purchase blockchain stocks via online brokerage companies like: These are the most common blockchain stock trading firms, especially for beginners. Cryptocurrency stocks are shares in publicly traded companies and funds that have significant exposure to cryptocurrency. Another way to gain investment.

How Do I Know If I Have Delinquent Accounts

If you are delinquent on your student loan payment for 90 days or more, your loan servicer will report the delinquency to the three major national credit. can't contact you at work if you tell them you're not allowed to get calls there delinquent taxes, child/spousal support, or student loans) include. Social. I'm just trying to find out how I can view the original delinquency date of a loan that was taken out and went delinquent in and then it disappeared off. If bills are unpaid, you have a balance remaining, AND you are no longer a current student the account becomes delinquent. Q: What are the consequences for. Delinquent Accounts / Reconnection Fees. Delinquent Accounts. Utility bills Service may also be disconnected if customer writes an insufficient funds check. Delinquent Account Checklist · Clear financial holds. Financial holds will not be removed until the balance has been paid in full. · Tax offset (SOIL) payments. Can there be estimated amounts due in the delinquent account? What information is published about each account? How do I know if my name may be published? How. Returned item unpaid/NSF check. Indicates that a web check or check payment Delinquent accounts. Any charges on a Western Michigan University billing. Most credit issuers maintain proprietary debt collection services for early delinquencies. However, delinquent credit card accounts that remain unpaid will. If you are delinquent on your student loan payment for 90 days or more, your loan servicer will report the delinquency to the three major national credit. can't contact you at work if you tell them you're not allowed to get calls there delinquent taxes, child/spousal support, or student loans) include. Social. I'm just trying to find out how I can view the original delinquency date of a loan that was taken out and went delinquent in and then it disappeared off. If bills are unpaid, you have a balance remaining, AND you are no longer a current student the account becomes delinquent. Q: What are the consequences for. Delinquent Accounts / Reconnection Fees. Delinquent Accounts. Utility bills Service may also be disconnected if customer writes an insufficient funds check. Delinquent Account Checklist · Clear financial holds. Financial holds will not be removed until the balance has been paid in full. · Tax offset (SOIL) payments. Can there be estimated amounts due in the delinquent account? What information is published about each account? How do I know if my name may be published? How. Returned item unpaid/NSF check. Indicates that a web check or check payment Delinquent accounts. Any charges on a Western Michigan University billing. Most credit issuers maintain proprietary debt collection services for early delinquencies. However, delinquent credit card accounts that remain unpaid will.

Delinquent Account Payments. If you have a financial hold, payment may be made by cash, debit/credit card, check, cashier's check or money order. Please. Services will not be disconnected for delinquency immediately preceding a weekend or a holiday. Delinquent accounts may be scheduled for immediate disconnection. FLYWIRE AND DELINQUENT ACCOUNTS. Collections Process. The student receivable process begins when charges are posted to. When contacting us about a delinquent account, have the following information available: Name and mailing address of the debtor; Telephone number where you. Individuals who have failed to pay their delinquent account balance may be reported to one or more nationally recognized credit reporting bureaus. The. Due Date and Delinquency Notice. The due date on a Utility Services Statement is 20 days after an account is billed. The first delinquent notice is 21 days. account and the monthly payments you must make on each. Your repayment history. Delinquent accounts. Derogatory accounts. Accounts that have been closed. The. Some credit scoring models may also treat different kinds of debt differently – for instance, medical bills versus delinquent credit card bills. If you have a. You can check your credit file to find out who you owe money to. It will show if you have any defaults, County Court judgments (CCJs) or decrees. delinquent list C.O.D. account. Log onto the Online Delinquency Management System using your license serial number and password. If you are not the license. The seriousness of a delinquent account is measured in days. To find out if you have a serious delinquency, here is a timeline along with the likely impact on. your name, address, and Social Security number; your credit cards; your loans; how much money you owe; if you pay your bills on time or late. Why do I have a. If the card/account is not paid on a timely basis, it will be considered delinquent and the contractor bank may suspend or cancel the account and assess late. My credit score is showing a "serious delinquency" that dropped my score by points. how can I check what it is? account is paid in full. Please contact the Bursar's Office at () to check the status of your delinquent account. Returned Checks. When a student's. Delinquent Accounts. If you owe delinquent (past due) money to the City of If you have additional questions or comments after reviewing the pages. Most credit issuers maintain proprietary debt collection services for early delinquencies. However, delinquent credit card accounts that remain unpaid will. If you dispute a debt in writing with a debt collector, that debt collector must tell any credit reporting company that it has reported your debt to that you. That delinquency can remain on your credit report for up to years. The best course of action when paying a delinquent account is to try and. Delinquent Accounts. Delinquent accounts are referred to collection agencies or attorneys and are reported to the credit bureau. · Student's Responsibility.

Voyager Limited

Voyager is a financial services company that generates revenue by providing execution for customer-initiated trades of certain digital assets and virtual. Voyager Limited. 1 like. We are an Anime/Manga inspired clothing brand providing the best gear the internet has to offer. This website is intended to keep Voyager creditors informed regarding the status of the Voyager bankruptcy cases. Company. Voyager Labs (founded ) applies its AI technology to real-world public safety and risk assessments issues. It operates worldwide through its. Inspired by the vacation hotspots around the world, Nahvalur presents the Voyage Vacation limited edition fountain pen. This large, piston-fill fountain pen. Voyager Therapeutics (Nasdaq: VYGR) is a biotechnology company dedicated to leveraging the power of human genetics to modify the course of – and ultimately cure. The Kramer Voyager's radical body shape is sure to draw attention! Featuring a comfortably contoured solid mahogany body, a fast-playing maple neck with a. SPHYRNIDAE AUTOMATIC LIMITED EDITION VOYAGER AUTOMATIC. No single man-made object lies further from Earth than. We are Voyager Space, a leading space company dedicated to bettering humanity's future through bold exploration, cutting-edge technologies. Voyager is a financial services company that generates revenue by providing execution for customer-initiated trades of certain digital assets and virtual. Voyager Limited. 1 like. We are an Anime/Manga inspired clothing brand providing the best gear the internet has to offer. This website is intended to keep Voyager creditors informed regarding the status of the Voyager bankruptcy cases. Company. Voyager Labs (founded ) applies its AI technology to real-world public safety and risk assessments issues. It operates worldwide through its. Inspired by the vacation hotspots around the world, Nahvalur presents the Voyage Vacation limited edition fountain pen. This large, piston-fill fountain pen. Voyager Therapeutics (Nasdaq: VYGR) is a biotechnology company dedicated to leveraging the power of human genetics to modify the course of – and ultimately cure. The Kramer Voyager's radical body shape is sure to draw attention! Featuring a comfortably contoured solid mahogany body, a fast-playing maple neck with a. SPHYRNIDAE AUTOMATIC LIMITED EDITION VOYAGER AUTOMATIC. No single man-made object lies further from Earth than. We are Voyager Space, a leading space company dedicated to bettering humanity's future through bold exploration, cutting-edge technologies.

Our second 4-CD presentation of exciting score highlights from the acclaimed television series STAR TREK: VOYAGER starring Kate Mulgrew, Tim Russ and Jeri Ryan. This Custom Voyager Cart is equipped with: Premium Vinyl Wrap 2-Year Full Coverage Warranty (includes Parts AND Labor) Allied Lithium 48V + Amp-hour. Wear the world on your wrist and embrace every second. Distinctive and hand-painted, no two dials are alike. Limited to pieces worldwide. Limited HQ Edition; Lucky Number 7 Voyager. +1. Voyager | 42MM. Each palette contains nine eyeshadows and two blushes, inspired by the colors and feeling that each destination brings. This limited-edition collection provides. Right Time International Watch Center proudly presents Voyager 44mm Blue Limited Edt gmc-lj-be wrist watch from our Ball Engineer Master I I collection. VOYAGER GROUP LIMITED - Free company information from Companies House including registered office address, filing history, accounts, annual return. The Voyager I-II-III: limited edition. Product categories: The Voyager I collection, The Voyager II collection, The Voyager III collection. Find many great new & used options and get the best deals for Star Trek Voyager Limited Edition for PC BIG BOX NEW at the best online prices at eBay! The VOYAGER series, introduced by BODERRY in , is a brand-new FIELD watch series that has received widespread acclaim globally since its launch. GAN ME 3x3 Magnetic (Voyager Limited Edition) is a great compromise for performance, customization, and cost! Voyager Worldwide is now a NAVTOR company. By joining forces helps to create maritime's greatest global leader, serving vessels worldwide. Voyager is an Operations & Demurrage Management Platform for Charterers. Trusted by some of the largest commodities shippers across multiple verticals. Buy Ball Engineer Master II Voyager Limited Edition GMT Blue Dial Men's Watch GMC-LJ-BE for only $ Free Shipping with a 30 Day Return Policy and. Voyager CCW- Limited Series · "Tail-less" waist strap system -Allows for easy strap size adjustment for comfort with no dangling tail of webbing and keeps. You have not specified your vehicle; therefore, we cannot guarantee this product will fit. Please confirm our limited liability for choosing your own wheel. Commissioned by Big O poster company, UK, in and later licensed by Wizard and Genius, Switzerland. Now it is only available as a limited edition. We're excited to announce that we've got a special limited run of our cherished Voyager overdrive with some killer new art by our friend Chris Castro. Voyager Company The Voyager Company was a pioneer in CD-ROM production in the s and early s. It was founded in by four partners: Jon Turell, Bill.